UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2014

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ______________

Commission file number 001-32521

Propanc Health

Group

Corporation

(Exact name

of registrant as

specified in its charter)

| Delaware | 33-0662986 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Level 13, Suite 1307, 530 Collins Street

Melbourne, VIC, 3000, Australia

(Address of principal executive offices) (Zip Code)

61 03 9614 2795

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act:

| Title

of each class registered: |

Name

of each exchange on which registered: | |

| Common Stock, $0.001 par value | Over-the-Counter Bulletin Board |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes oNo x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the Company’s common stock held by non-affiliates computed by reference to the closing bid price of the Company’s common stock, as of the last business day of the registrant’s most recently completed second fiscal quarter: $5,182,094.20.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date: 82,444,100 shares of common stock, par value $0.001 per share, issued and outstanding as of October 14, 2014.

TABLE OF CONTENTS

| 2 |

Forward-Looking Statements

Certain statements in this Annual Report on Form 10-K constitute “forward-looking statements” made under the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 that are based on current expectations, estimates, forecasts and assumptions and are subject to risks and uncertainties. Words such as “anticipate,” “assume,” “believe,” “estimate,” “expect,” “goal,” “intend,” “plan,” “project,” “seek,” “target,” and variations of such words and similar expressions are intended to identify such forward-looking statements. All forward-looking statements speak only as of the date on which they are made. Such forward-looking statements are subject to certain risks, uncertainties and assumptions relating to certain factors that could cause actual results to differ materially from those anticipated in such statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

| 3 |

General

As used in this Annual Report, references to “the Company”, “Propanc”, “we”, “our”, “ours” and “us” refer to Propanc Health Group Corporation and consolidated subsidiaries, unless otherwise indicated. In addition, references to our “financial statements” are to our consolidated financial statements except as the context otherwise requires.

We prepare our financial statements in United States dollars and in accordance with generally accepted accounting principles as applied in the United States, referred to as U.S. GAAP. In this Annual Report, references to “$” and “dollars” are to United States dollars.

Overview

We are a development stage healthcare company that is currently focused on developing new cancer treatments for patients, suffering from pancreatic and colorectal cancer. Together with our scientific and oncology consultants, we have developed a rational, composite formulation of anti-cancer compounds, which together exert a number of effects designed to control or prevent tumors recurring and spreading through the body. Our leading products are variations upon our novel formulation and involve or employ pro-enzymes, which are inactive precursors of enzymes. As a result of positive early indications of the anti-cancer effects of our technology, we intend to submit our pro-enzyme treatment to the rigorous, formal non-clinical and clinical development and trial processes required to obtain the regulatory approval necessary to commercialize it and any product(s) derived and/or to be derived therefrom.

In the near term, we intend to target patients with limited remaining therapeutic options for the treatment of solid tumors such as colorectal or pancreatic tumors. In the future, we intend to development our lead product to treat (i) early stage cancer and (ii) pre-cancerous diseases and (iii) as a preventative measure for patients at risk of developing cancer based on genetic screening.

Key Highlights of this opportunity are:

| · | Potential cancer treatment: a once-daily pro-enzyme treatment as a clinically proven therapeutic option in cancer treatment and prevention. |

| · | Multiple mechanisms of action on cancerous or carcinogenic cells: our treatment exerts multiple effects on cancerous cells which inhibits tumor growth and potentially stop the tumor from spreading through the body in contrast to cancer treatments currently available that lack sufficient efficacy to achieve a durable clinical response by preventing tumor recurrence, or inhibiting new growths which spread through the body. As we progress our research, we intend to elucidate further the multiple mechanisms of action to identify opportunities to expand our intellectual property portfolio. Furthermore, we hope to uncover the molecular targets of the pro-enzymes to identify potential opportunities for developing new compounds. |

| · | Encouraging data from patient treatment: Scientific research undertaken over the last 15 years and clinical experience from treating patients in the United Kingdom (the “UK”) and Australia has provided evidence that PRP may be an effective treatment against cancer and warrants further development. |

| 4 |

| · | Unique intellectual property: We are focusing on building a significant portfolio of intellectual property around the use of pro-enzymes in the treatment of cancer, identifying new formulations, alternative routes of administration and potential new therapeutic targets. The PRP drug product is an enhanced pro-enzyme formulation comprising amylase and pro-enzymes of trypsinogen and chymotrypsinogen, in a specific ratio which synergistically enhances the anti-cancer effects of the pro-enzymes compared to when used as singular entities. Patent protection is currently being sought for this PRP drug product, which forms part of the subject matter of International (PCT) Patent Application No. PCT/AU2010/001403 filed on October 22, 2010 in the name of Propanc Pty Ltd. This international PCT application also includes the priority filings of Australian provisional patent application # 2009905147 and # 2010902655, which were filed on October 22, 2009 and June 17, 2010 respectively (as discussed under the section “Intellectual Property”). The PRP-DCM drug product also forms part of the subject matter of International (PCT) Patent Application No. PCT/AU2010/001403. The Authorized Officer indicated in the Written Opinion issued for this international PCT application, that the patent claims covering the PRP and PRP-DCM products were novel over the prior art cited in the International Search Report. Various national phase applications are being filed in countries around the world based on the above priority applications. |

| · | Market opportunity: Growing demand for new cancer treatments as a result of a rapidly aging population and changing environmental factors in western countries. According to the World Health Organization, all cancers (excluding non-melanoma skin cancer) are expected to increase from 8.2 million annual deaths in 2012 to over 10 million annual deaths by 2020, exceeding 13 million annual deaths by 2030. |

Company History

Propanc Health Group Corporation, formerly Propanc PTY Ltd., is a development stage enterprise and was incorporated in Melbourne, Victoria Australia on October 15, 2007. Based in Melbourne, Victoria Australia, since inception, substantially all of the efforts of our company have been the development of new cancer treatments targeting high risk patients who need a long term therapy which prevents the cancer from returning and spreading. The Company anticipates establishing global markets for its technologies.

On November 23, 2010, Propanc Health Group Corporation was incorporated in the state of Delaware. In January 2011, to reorganize the Company, Propanc Health Group Corporation acquired all of the outstanding shares of Propanc PTY Ltd. on a one-for-one basis making it a wholly-owned subsidiary.

We were formed for the specific purpose of having shareholders of Propanc PTY Ltd. directly owning an interest in a U.S. company. On January 29, 2011, we issued 64,700,525 shares of our common stock in exchange for 64,700,525 shares of Propanc PTY Ltd. common stock.

Company History

Propanc’s scientific roots date back almost 100 years to the work of Professor John Beard at the University of Edinburgh in the United Kingdom (the “UK”) whose pioneering work on tumor cell biology and potential new approaches to treating cancer by targeting specific pathways which kill off cancer cells, but leave healthy cells alone. In more recent times interest in the work of Professor Beard has re-emerged, driven by the insights into his work offered with modern day knowledge of tumor cell and molecular biology.

| 5 |

Important Milestones for Propanc

| · | From the late 90’s, work from other scientists and clinicians, including Dr. Josef Novak in the U.S. and a since retired oncologist, Dr. Frantisek Trnka, from the Czech Republic, shed new light on the therapeutic potential of Professor Beard’s insights. Extensive laboratory work undertaken over a number of years by Novak and Trnka was reported in the journal Anticancer Research in 2005 in the paper entitled ‘Pro-enzyme Therapy of Cancer’. The conclusion of Novak and Trnka from this work was the discovery “that pro-enzyme therapy mandated first by John Beard nearly one hundred years ago, shows remarkable selective effects that result in growth inhibition of tumor cells with metastatic potential”. Today, these important scientific observations support our view that pro-enzymes are selective and effective in targeting malignant tumor cells and could become an effective tool in the fight against metastatic cancer. |

| · | In 2007, Dr. Julian Kenyon, Medical Director of the Dove Clinic in the United Kingdom and Dr. Douglas Mitchell, further developed the therapeutic concepts of Beard and identified strategies which could improve upon the therapeutic potential of Beard’s original ground-breaking work. A suppository formulation was developed by Mandeville Medicines, Buckinghamshire, UK, at the request of, and in consultation with, Dr. Kenyon and Dr. Mitchell, in an effort to improve on results reported in the literature pertaining to the potential therapeutic use of pro-enzymes in cancer treatment. Patients were first treated with the suppository formulation in April 2007 at The Dove Clinic, UK and in July 2007 at the Opal Clinic, Australia. Drs. Kenyon and Mitchell, through The Dove Clinic and Opal Clinic respectively, treated cancer patients in the United Kingdom and Australia with a suppository formulation of pro-enzymes. The treatment was undertaken under special UK and Australian regulatory provisions. In the UK it was undertaken under the Medicines and Healthcare Products Regulatory Agency (the “MHRA”)’s regulations designed for patients who have special clinical needs that cannot be met by licensed medicinal products, and in Australia under the Therapeutic Goods Administration or TGA Special Access Scheme, a mechanism which provides for the import and/or supply of an unapproved therapeutic good for a single patient, on a case by case basis. In both jurisdictions, patients are permitted to receive treatment on an individual basis for compassionate use as long it is supplied by a recognized, licensed manufacturer who is able to meet certain guidelines for unapproved products, and individual case files are maintained for patients should the regulatory authorities require this information. No prior approval was required by either the MHRA or TGA prior to the commencement of treatment. No suppository formulation of the pro-enzymes was available and it was necessary for a novel suppository formulation to be manufactured specifically for these patients by a suitably licensed manufacturer. |

| · | Forty-six late stage cancer patients suffering from a range of malignancies in the UK and Australia received treatment with the pro-enzyme suppositories over periods of time ranging from one (1) month to in excess of seventeen (17) months. Inspired by their observations in clinical practice, Dr. Kenyon and Dr. Mitchell resolved to develop pro-enzyme therapy for cancer patients worldwide. |

| · | Late 2007, Dr. Kenyon, Dr. Mitchell and Mr. James Nathanielsz, our Chief Executive Officer, developed a strategy to commercialize the newly developed pro-enzyme formulation, now designated PRP. Propanc Pty Ltd, a subsidiary of Propanc Health Group Corporation, was established in Australia to refine, develop and commercialize novel, patented pro-enzyme therapeutics for the treatment of cancer. This remains our intention to date. |

| · | In 2008, a Scientific Advisory Board (the “Advisory Board”) comprising Professor John Smyth (Edinburgh University), Professor Klaus Kutz (Bonn University) and Professor Karrar Khan (De Montfort University) was established. Dr Ralf Brandt, Chief Executive Officer and Founder of preclinical Contract Research Organization (CRO), vivoPharm Pty Ltd., was later appointed to the Board in 2011. Today, the expertise of the Advisory Board in oncology research and development will be relied upon as we initiate patient trials and advance our products down the requisite regulatory pathways to commercialize our pro-enzyme therapies. |

| · | In 2009, a retrospective review of the patient notes from the forty-six (46) patients treated was undertaken by Dr Kenyon. This report was subject to analysis by Professor Klaus Kutz who, at the time of the review, was an independent consultant in clinical pharmacology and safety, specializing in oncology. Professor Kutz observed that no patients were reported as living for a period less than that predicted by the treating clinician and a number of terminally ill patients lived marginally longer than predicted, particularly those suffering from pancreatic, colorectal, ovarian and gastro-intestinal cancers. As a result of the observations made by Dr Kenyon and Professor Kutz, we are targeting the development of pro-enzyme therapy for the treatment of colorectal and pancreatic cancers for clinical trials, and in the future targeting other cancer types as our product candidate progresses to commercialization. |

| 6 |

| · | In early 2008, a research collaborative partnership was established with Professor David Tosh, at the Center for Regenerative Medicine, Deparment of Biology and Biochemistry, Bath University, to investigate the molecular mechanisms by which the pro-enzyme formulation is acting, which resulted in us filing two provisional patents a year later. We undertook additional scientific research with Professor Tosh, Dr. Macarena Pèran, Department of Health Sciences, Jaén University, and Dr. Juan Antonio Marchal, Biopathology and Regenerative Medicine Institute, Granada University. Important anti-cancer effects of the pro-enzymes were discovered, including triggering cell necrosis (cell death) and apoptosis (programmed cell death) and significantly, the induction of cell differentiation (i.e. inducing cancer cells to exhibit normal cell behavior). This led to us increasing our intellectual property base and patent new pharmaceutical compositions designed to enhance the effects of pro-enzymes. Subsequently, two provisional patents were combined into one Patent Cooperation Treaty (PCT) Application, filed on 22 October 2010 (PCT Application), and then a year later, we completed a 30 month national phase filing deadline for an international patent and commenced entering the national phase in countries around the world. So far, we received grant status in South Africa and more recently in New Zealand. In addition, the United States Patent and Trademark Office or USPTO and European Patent Office or EPO have made preliminary indications that key features of our technology are patentable. We are presently working towards securing a patent in each region, covering as many aspects of its technology as possible, whilst also actively seeking protection throughout Eastern Europe, Asia and South America. |

| · | Late 2010, we made additional important discoveries and scientific observations, resulting in additional composition claims which were included in the PCT Application, further protecting the company’s pro-enzyme formulation. Collaboration with vivoPharm Pty Ltd. (vivoPharm), located in Melbourne, Australia, with research facilities in Hershey, Pennsylvania, United States, identified a highly synergistic ratio of the pro-enzymes when combined together, resulting in increased anti-cancer effects in several tumor cell lines. By 2011, further work completed by vivoPharm confirmed the anti-metastatic effects of the newly combined ratio of the pro-enzymes in various cell line assays, and anti-angiogenic (inhibition of blood vessel formation) properties of the pro-enzyme treatment in mice. |

| · | In mid-2012, we began trading on the Over the Counter Bulletin Board (“OTCBB”). At the time, whilst located in Melbourne, Australia, we decided to access the US capital markets for raising the capital needed to finance the company’s pro-enzyme treatment for future clinical trials. Today, after deepening our scientific knowledge of the anti-cancer effects of pro-enzymes through our ongoing efforts with our research partners and strengthening our intellectual property portfolio by filing our patents in countries around the world, we are ready to complete the formal animal studies necessary to undertake human trials in 2015. |

| · | In May 2013, it was observed that pro-enzymes enforce the re-entry of cancer cells back into normal cellular pathways and this may represent a novel approach to the treatment of cancer. These findings were published in Cellular Oncology, a peer reviewed journal of the International Society for Cellular Oncology. |

The Problem

In the early phases of tumor progression, cancer cells multiply near the site where their predecessors first began uncontrolled proliferation. The result, usually over a long period of time, is a primary tumor mass. Tumors often need to reach a large size before they make themselves apparent to the individual concerned, or the clinician screening for them.

| 7 |

Eventually, tumors of substantial size may begin to compromise the functioning of organs in which they have arisen and begin to evoke symptoms. In many cases, the effects on normal tissue function come from the physical pressure exerted by the expanding tumor masses. For example, large tumors in the colon may obstruct digestion products through the lumen, or in the lungs, airways may be compromised.

As dangerous and threatening as these primary tumors are, they are ultimately responsible for only about 10% of deaths. A far greater threat often arises for the patient, even after a primary tumor has been identified and removed. This threat involves cancerous growths that are discovered at sites far removed from the locations in their bodies where their primary tumors first appeared. These cancerous growths, called metastases, are responsible for 90% of patient deaths from cancer. Metastases are formed by cancer cells that have left the primary tumor mass and traveled by the body’s blood and lymphatic vessels (a vein like vessel carrying lymph, or white blood cells, from the tissues) to seek new sites and form new colonies. For example, breast cancers often spawn metastatic colonies in many tissues throughout the body including the brain, liver, bones, and lungs.

For primary tumors which have not yet metastasized, current treatments for cancer can be effective in initially reducing tumor burden. However, for many forms of cancer, current treatments lack sufficient efficacy to achieve a long lasting clinical response. Therefore, a vast majority of patients who succumb to cancer are killed by tumors that have metastasized. Continuing with the example of breast cancer, according to the National Cancer Institute’s SEER Cancer Statistics Review (2001 – 2007), of the patients diagnosed with late stage metastatic breast cancer, only 23% are expected to live longer than five years. This is compared to a 98% five year survival rate for an early stage breast cancer patient when the cancer is confined to the primary site.

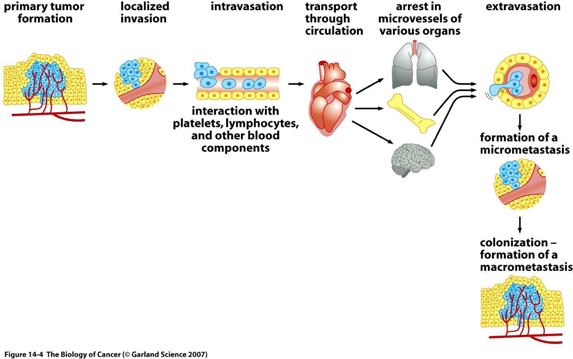

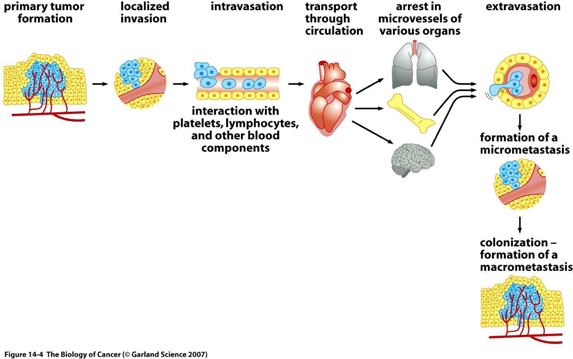

The invasion-metastasis cascade

The great majority of life threatening cancers occur in epithelial tissues, yielding carcinomas. Epithelial cells generally have a multi-sided, uniform shape. They have well defined contact points with neighboring cells and a strong attachment to the underlying connective tissue, or stroma, which creates a framework for solid tumors in the body. Separating the two is the specialized type of extracellular matrix, known as the basement membrane.

By definition, carcinomas which originate on the epithelial side of the basement membrane and are considered to be benign, as long as the cells forming them remain on the same side. However, many carcinomas acquire the ability to penetrate the basement membrane, and individual cancer cells or groups of cancer cells begin to invade the stroma. This mass of cells is now reclassified as malignant. Often, many pathologists and surgeons reserve the label “cancer” for those epithelial tumors that have acquired this invasive ability.

Thereafter, carcinoma cells may invade into lymphatic or blood microvessels. The latter may then transport these cancer cells to distant sites in the body where they may be trapped and subsequently form new metastases.

| 8 |

It is important to note, that even before cells penetrate the basement membrane, they often stimulate angiogenesis (blood vessel formation) on the stromal side of the membrane, by expressing angiogenic proteins through the porous barrier. Not only does this enhance the ability of malignant cells to circulate into the blood, but also provides an important feedback loop for the cancer cell to maintain its invasiveness.

Understanding the mechanism by which benign cells change to a malignant state is therefore pivotal to developing anti-cancer treatments that have sufficient efficacy to achieve a long lasting clinical response.

The epithelial-mesenchymal transition and associated loss of E-cadherin expression enable carcinoma cells to become invasive.

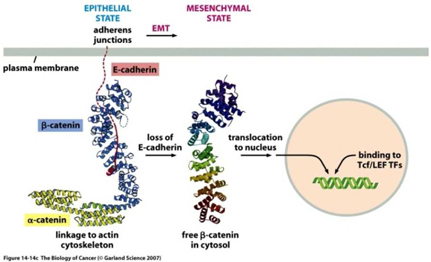

Epithelial cells can undergo a transformation to a different cell type, called mesenchymal cells, through a process called the epithelial-to-mesenchymal transition, or EMT. Mesenchymal cells have an elongated spindle shape; lack orderly contacts with neighboring cells and can survive without contact with a surface or connective tissue. The EMT process is a series of events that normally occur during the development of tissues and organs prior to birth, and also apply to normal wound healing processes. However, the same EMT process can also be applied to epithelial cancer cells, or carcinomas. When epithelial carcinoma cells residing in a solid tumor undergo the EMT process, the resulting mesenchymal cancer cells can invade through local barriers and metastasize to other parts of the body.

In addition to becoming invasive and motile after undergoing the EMT process, the resulting mesenchymal cells have significantly increased resistance to current cancer treatments. For example, in Cancer Research in 2005, it was reported that lung cancer cells expressing mesenchymal biomarkers appeared to be resistant to Tarceva and other targeted anti-cancer agents when transplanted into mice.

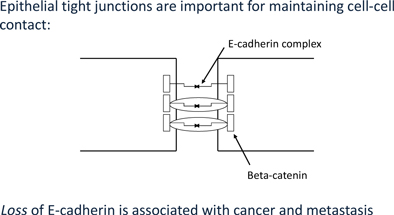

At the center of this critical process for transforming benign cells into carcinomas, is the protein Epithelial Cadherin, or E-Cadherin. In normal cells, E-cadherin is located in the membrane and involved in maintaining cell to cell contact, which is critical to normal function and structure of epithelial tissues. The individual E-Cadherin molecules are attached to the actin (scaffolding, or cytoskeleton structure) within the cell, anchored by β-catenin, a protein which helps form the junction between epithelial cells. As well as forming an anchor between epithelial cells, β-catenin is also involved in gene transcription, a process by which DNA (deoxyribose nucleic acid) is converted into RNA (ribose nucleic acid) within the nucleus of a cell for the purpose of producing new proteins normally associated with routine cell function.

| 9 |

In the case of tumors, when cells become invasive, E-Cadherin expression decreases substantially, β-catenin becomes free within the cell, which may then migrate to the nucleus and induce expression of the EMT program. Furthermore, once cells undergo an EMT, they begin to produce their own cytokines (cell signaling molecules), such as Transforming Growth Factor β, or TGF-β. This protein plays a critical multi-functional role in promoting angiogenesis, immunosuppression (suppressing the immune system from recognizing and attacking cancer cells), and maintaining their mesenchymal cell structure for prolonged periods via a feedback mechanism. Studies also suggest that TGF-β works with β-catenin to cause epithelial cancer cells to undergo an EMT.

A study in the British Journal of Cancer, 2011, demonstrated that in cholangiocarcinoma (bile duct cancer) cell lines, treatment of TGF-β increased cell migration, invasion and mesenchymal changes. Furthermore, expression of E-cadherin and N-cadherin was measured from resected (cut out) specimens from extra-hepatic (outside the liver) cholangiocarcinoma patients. Patients with low E-cadherin expression had a significantly lower survival rate than patients with high E-cadherin expression. They concluded the cadherin switch via TGF-β induced EMT in extra-hepatic cholangiocarcinoma leads to cancer progression.

| 10 |

Conversely, in studies of several types of carcinoma cells that had lost E-cadherin expression, re-expression of this protein strongly suppressed the invasiveness and motility of these cancer cells.

Together, these observations indicate that E-Cadherin levels is a key determinant of the biological behavior of epithelial cancer cells and that the cell to cell contact constructed by E-cadherin molecules impede invasiveness and hence metastasis.

Our Solution

Our solution is to develop and commercialize a long-term therapy to prevent tumor recurrence and metastases, the main cause of patient death from cancer. We believe this problem can be addressed by developing a pro-enzyme formulation specifically targeting malignant carcinoma cells to and create a long lasting clinical benefit to the patient.

Propanc’s Theory Pro-enzymes Regulate Cell Proliferation

More than 100 years ago, Professor Beard, a comparative embryologist, made an observation that the pancreas develops in most vertebrates at the time when the placenta begins to slow its rate of growth. He hypothesized that enzymes produced by the developing pancreatic gland curtail trophoblastic invasion (A rare condition in which abnormal cells grow inside the uterus from tissue that forms after conception) and suggested that pancreatic extracts should have a similar inhibitory effect on invasive tumors.

Subsequently in the late 90’s, after following Professor Beard’s recommendations, Novak and Trnka hypothesized that administration of pro-enzymes, rather than the enzymes, was of crucial importance to the clinical effectiveness of the treatment approach first developed by Professor Beard, and that the precursor nature of the active enzymes may offer protection against numerous serpins (proteins which can inhibit pro-enzymes) in the blood.

As knowledge of tumor cell and molecular cell biology has increased over the years, our scientists and research partners have made important scientific discoveries identifying that pro-enzymes suppress the EMT program and induce cell differentiation, i.e., return cancerous cells towards normal cell behaviour, or a benign state.

After more than 100 years, the initial observations made by Professor Beard may have a potential common link between embryogenesis and cancer, by which cells are able to become motile and invasive, via the EMT program, where the administration of pro-enzymes may regulate cell proliferation as a means to controlling carcinomas.

Our Product Candidates

We are using our intellectual property and expertise to develop a pro-enzyme therapy for the treatment and prevention of the development of carcinomas from solid tumors. Initially, our products will be used in the treatment of pancreatic and colorectal cancers. In the future, we intend to expand our products scope in anti-cancer treatment to include other common solid tumors such as ovarian, gastrointestinal and prostate cancers.

PRP

Our lead product, PRP, is a novel, patented, formulation consisting of two pro-enzymes; trypsinogen and chymotrypsinogen, plus the enzyme amylase (1, 4-α-D-glucan glucanohydrolase). In limited human testing as described earlier, supplemented by laboratory research at the Universities of Bath and Granada on the mechanism of action of the pro-enzyme mixture, evidence has been obtained which suggests PRP may be effective against a range of solid tumors.

| 11 |

Selectivity

Research published in 2005, suggests that the pro-enzymes in our product, typsinogen and chymotrypsinogen exhibit specificity for tumor cells and not normal cells.. Once activated, they in turn activate Protease Activated Receptors Type 2 (PAR2), which are located on the cell membrane and involved with cancer cell proliferation. Activation of PAR 2 results in a cascade of intracellular activities, including activation of a major component of the cell which controls its structure and architecture, the actin cytoskeleton. In a cancer cell, pro-enzymes have the effect of converting globular actin into filamentous actin, which causes the cell structure to collapse and induce cell death. This reduces tumor volume and is often seen in clinical practice.

In addition, the enzyme amylase contributes to the anti-tumor activity by splitting the carbohydrate element of glycoproteins on the surface of the tumor cell; this action is facilitated by the activated proteases around the cell.

Anti-Cancer Effects and Mechanism of Action

PRP consists of pro-enzymes which are known to influence a number of pathways critical for cancer cells to invade, grow and metastasize. Research published in 2013, shows the clinical benefits of PRP appear to result from enhanced differentiation of tumor cells, which inhibits proliferation and consequently, reduces their ability to invade and metastasize.

Specifically, we showed that pro-enzymes:

| · | induce a dose-dependent inhibition of cell growth, triggering apoptosis and cell necrosis; |

| · | enhance expression of epithelial markers, such as E-cadherin and β catenin; |

| · | decrease expression of EMT transcription factors responsible for coding specific gene sequences from DNA, associated with TGF-β cell signalling pathways; and |

| · | induce malignant cells to differentiate to benign forms. |

Once activated, pro-enzymes influence the micro-immune environment around the cell, altering a number of pathways critical for supporting cancer cell growth, invasion and metastasis. This includes interacting with proteinases and cell signaling pathways in the extracellular matrix, whilst also interacting directly with cell surface proteins that effect the internal pathways of the cancer cell, triggering re-expression of epithelial markers, reducing important EMT markers, and inducing a series of cellular activities which alters the cancer cell’s morphology (structure) from a malignant to a benign state.

Preclinical Development

PRP activates E-Cadherin and β-Catenin Expression, Inhibiting Cell Growth in a Dose Dependent Manner

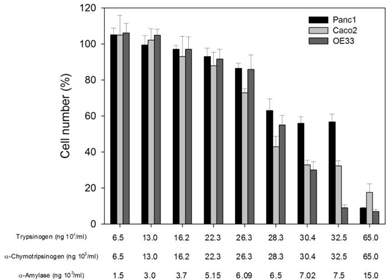

Initial experiments were performed to determine the effects of PRP on cell growth. Increasing doses of the pro-enzymes in PRP, trypsinogen and chymotrypsinogen were administered at increasing concentrations on three cancer-derived cell lines, including colorectal (Caco-2), pancreatic (Panc1) and esophageal (OE33) carcinomas.

Overall the cell numbers of these three cell lines slightly decreased at concentrations of ≤22 × 103 ng per mL for both trypsinogen and chymotrypsinogen, and ≤5.15 × 103 ng per mL for amylase. However, at ≤28 × 103 ng per mL for both trypsinogen and chymotrypsinogen, and ≤6.15 × 103 ng per mL for amylase, the cell numbers dropped sharply to below 60% and significantly decreased further at higher concentrations, especially for Caco-2 and OE33 carcinoma cell lines. These results suggest that PRP affects cellular growth in a dose dependent manner.

| 12 |

PRP increases the Expression of Epithelial Markers in Carcinomas

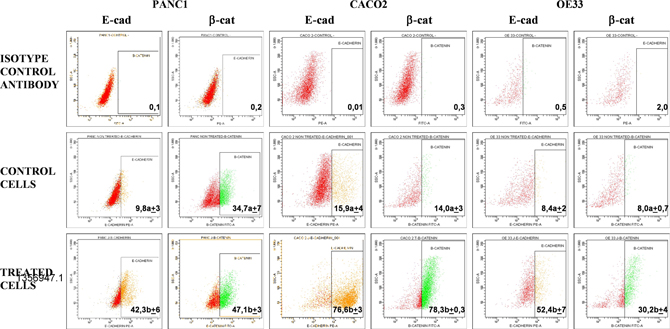

Upon treatment with PRP, changes in expression of the epithelial markers β-catenin and E-cadherin were assessed in Caco-2, Panc1 and OE33 cells. Subsequent flow cytometry analysis (flow cytometry is a laser-based technology that quantitate properties of single cells, one cell at a time) revealed that expression of E-cadherin in Caco-2 cells increased to 76.6% ± 3.0 when cells were treated with PRP, as compared to a control using untreated cells (15.9 % ± 4.2).

Changes in the expression of β-catenin in Caco-2 cells were also observed with an increase from 14.0 % ± 3.5 in control cells to 78.3% ± 0.3 after PRP treatment. E-cadherin expression increased to 42.3 %±6.1 and β-catenin to 47.1% ± 3.3 when Panc1 cells were treated with PRP, while in control cells the respective expression levels were 9.8 %± 2.9 and 34.7 %±7.4. Finally, PRP treated OE33 cells also showed an increment of both epithelial markers compared to untreated control cells, i.e., E-cadherin increased up to 52.4 %±6.8, whereas control cell expression was 8.4 %± 2.1, and β-catenin increased up to 30.2 %±4.2, whereas untreated control cells showed 8.0 %±0.7 expression. In all cases differences between untreated and PRP treated cells were statistically significant (p<0.05).

| 13 |

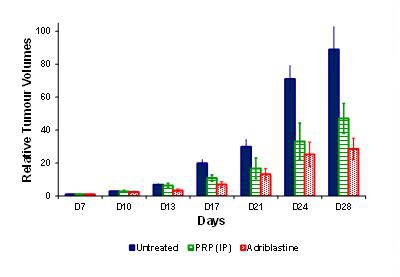

PRP has proven anti-tumor efficacy in Melanoma (B16-F10) Tumor Bearing Mice

The anti-tumor activity of PRP was assessed in a B16-F10 melanoma model. The tumors were grafted under the skin in C57BL/6 female mice. The tumor-bearing mice were dosed with PRP twice daily, vehicle or control (doxorubicin (Adriblastine™) dosed once at 12 mg/kg i.v (i.e. approximately four-times the clinical dosage based on mg/kg conversion to a 60 kg human) for 28 consecutive days (n = 10 for each group). Treatment began 7 days post-implant.

During the course of the experiment, animals were sacrificed if any of the following occurred: signs of suffering (cachexia, weakening, difficulty moving or eating), compound toxicity (hunching, convulsions, diarrhea), tumor growing to 10% of body weight, tumor ulcerating and remaining open, position of tumor interfering with movement/feeding, 15% body weight loss for 3 consecutive days or 20% body weight loss for 1 day. The mice were sacrificed when the tumor volume reached a maximum volume of 2,000 mm.

Treatment with PRP was well tolerated following intra-peritoneal (i.p) injection into mice. Observations were specifically made to observe any drug-related toxicity (including hunching, convulsions, and diarrhea). There were no adverse events attributable to PRP, nor injection site reactions. Following 21 days treatment (28 days post-implantation), relative tumor volumes (defined as tumor volumes measured x number of days post treatment, divided by the tumor volume measured at day 0, post treatment) were significantly smaller in the i.p. and adriblastine groups compared to the untreated control.

This experiment shows our product, PRP has anti-tumour efficacy in mice, but without the severe, or even serious side effects normally associated with current treatment standards such as chemotherapy.

PRP-DCM

To date, we have been focused on developing a novel combination of anti-cancer agents working in combination with pro-enzymes which enhance PRP’s anti-cancer effects. The enhanced pro-enzymes-based formulations combine PRP with at least one of two types of identified compounds considered on the basis PRP’s mechanism of action to synergistically enhance the anti-cancer effects of PRP.

| 14 |

Our recent work has focused on maximizing the potential of PRP as a drug suitable for long-term maintenance by enhancing the effects of our current pro-enzyme formulation by screening additional active ingredients to enhance the anti-cancer activity of PRP.

Propanc’s scientists believe the additional ingredients identified in the course of this research to augment anti-cancer activity of PRP may also be suited as a stand-alone, adjunct therapy for standard treatment approaches, such as chemotherapy.

Anti-Cancer effects and mechanism of action

Cells obtain the energy they require from aerobic or anaerobic respiration (with, or without oxygen, respectively). It has been suggested that tumor cells rely on anaerobic respiration due to impairment of the mitochondria (an organelle found in most cells, in which the biochemical processes of respiration and energy production occur). We have identified compounds which have pronounced effects on the anaerobic cells within a tumor, which would complement PRP and standard treatment approaches:

| · | 2-deoxy-D-glucose, a metabolite which inhibits glucose metabolism in cancer cells, as reported in the British Journal of Cancer, 2002; |

| · | Capsiate, a non-pungent component from sweet peppers, induces apoptosis by increasing the production of oxygen in cancer cells through forced up-regulation of cell mitochondria, published in the European Journal for Nutrition, 2003; |

| · | Methyl-seleno-cysteine, which at low doses increases the oxidative stress on cancer cells by inhibiting a specific enzyme known to be up-regulated in tumor cells, published in Biochemical Pharmacology, 2008. |

Preclinical Development

In November 2010, we established collaborative research partnership with Dr. Paul Clayton, an expert in cancer prevention and nutrition and former advisor to the Committee on Safety of Medicines (UK), identifying specific anti-cancer agents in combination with one another, and with PRP, enhancing their ability to target cancerous cells with minimal side effects to healthy cells.

As a result of the work undertaken in collaboration with Dr. Paul Clayton, an international PCT application was filed late 2010, detailing enhanced pro-enzyme patent formulations and combination therapies comprising trypsinogen and chymotrypsinogen. Dr. Clayton was awarded a success fee in the form of shares of our common stock representing 1% of the shares then currently issued and outstanding in recognition of his contribution to this research. The patent application is jointly owned by us and the University of Bath, with an exclusive right and license to commercialize any joint intellectual property being held by Propanc (see under License Agreements and Intellectual Property for further details).

Effects on Cell Growth Inhibition Alone and In Combination

The interaction that occurs between agents can be described as synergistic, additive or antagonistic. The work we have conducted to enhance the anti-cancer effects of PRP focused on the positive therapeutic outcome of drug interactions, specifically synergism. The major benefits of additive and synergistic drug interactions are increased efficacy and significantly diminished toxic side effects. This can be achieved by reducing the dose of a drug that elicits damaging side effects, through a combination with another drug. Alternatively, a drug with insufficient efficacy could produce super-additive (synergistic) effects in a well-designed combination.

IC50 determination assays (the concentration of drug to cause 50% reduction in proliferation of cancer cells) were performed for 2-deoxyglucose, capsiate, methyl-seleno-cysteine and the mixture of these three components (i.e. DCM) in a human colorectal carcinoma cell line, HCT-15. IC50 values were obtained for 2-Deoxyglucose, capsiate and DCM. Methyl-seleno-cysteine treatment of the cells resulted in a maximum growth inhibition of 14.8% at the maximum tested concentration and therefore, an IC50 value was not obtained for this Test Article.

| 15 |

Following the IC50 determination assays, a scientific method was employed to study the interaction between 2-deoxy glucose, capsiate and methyl-seleno-cysteine. We found:

| · | capsiate, 2-deoxyglucose and DCM are inhibitors of the growth of the human colorectal carcinoma cell line HCT-15 in vitro; and |

| · | methylselenocysteine and 2-Deoxyglucose synergise to inhibit the growth of the human colorectal carcinoma cell line HCT-15. |

We have also made several other similar observations with other compounds that act to inhibit the growth of the human colorectal carcinoma cell line HCT-15. Further work is needed to assess the optimal combination of ingredients before undertaking formal preclinical development of a potential new combination therapy in animals. We will determine a final combination to be developed as an adjunct therapy to PRP .

Preclinical development

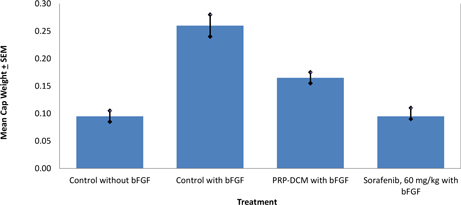

The anti-angiogenic efficacy of PRP in combination with DCM was investigated using vivoPharm's AngioChamber™ assay. The AngioChamber™ assay utilises the normal physiological process of wound healing, to promote fibrous capsule formation around an implanted chamber in mice. The inclusion of Basic Fibroblast Growth Factor (bFGF) in the chamber supports the fibrouse capsule formation while inducing blood vessel development. Thus, this system is used to assess the efficacy of anti-angiogenic treatments by measuring fibrous capsule formation (wet weight of capsule at termination).

Fifty female FvB mice each received a subcutaneously implanted AngioChamber™, with or without bFGF. Ten mice were randomly selected and implanted with Chambers without bFGF. Forty mice which were implanted with Chambers containing bFGF were randomised by body weight into four treatment groups of 10 mice on Day 0 of the study. A reference compound, Sorafenib (60 mg/kg, per oral) was also introduced into the study.

In this Study both treatments resulted in significant inhibition of bFGF-induced angiogenesis compared with the Induction Control, as indicated by the capsule wet weights on the termination day of the study. Both the reference compound, Sorafenib, and the combination of PRP-DCM significantly reduced angiogenesis.

As is frequently seen in cancer research, animal cancer models using PRP and DCM in combination have in some instances shown very encouraging results, with less clear cut results in other animal models. We are working to understand which models are most appropriate, and how to further optimize the DCM formulation as a possible adjunct therapy for use, either in combination with PRP, or other standard treatment approaches.

| 16 |

The PRP Formulation

Oral pancreatic enzymes have been administered previously in a variety of circumstances, and are in current clinical use in conditions where the pancreas is unable to produce sufficient enzymes for the digestion of food. A number of oral pancreatic enzyme products are presently approved in the U.S for use in patients who do not produce enough pancreatic enzymes. Approved pancreatic enzyme products include Pancreaze™ from Johnson & Johnson, CREON® from Abbott Laboratories, and ULTRASE® from Axcan Pharma US.

PRP is a combination of two pro-enzymes trypsinogen and chymotrypsinogen, specifically formulated within a specific ratio designed to synergistically enhance their anti-cancer effects and in combination with other therapies identified based on the mechanism of action. Patent protection is currently being sought for PRP and other potential combinations, which forms part of the subject matter of International (PCT) Patent Application No. PCT/AU2010/001403 filed on 22 October 2010 in the name of Propanc Pty Ltd, our Australian operating subsidiary.

Oral enzymes have also been investigated previously for the treatment of cancer and, whilst generating encouraging results, their widespread use has been hampered by the very large quantities that have been considered necessary for effective treatment – 130 or more tablets per day. The high dose used with oral delivery is considered necessary due to the oral enzymes being broken down in the stomach and duodenum, the first part of the small intestine, and very little actually being absorbed into the general circulation. By administering a pro-enzyme by intravenous or I.V. injection, and using a specific pro-enzyme formulation, the normal breakdown of the enzymes when taken orally is avoided and the drug can potentially be absorbed into the general circulation intact. It is also suggested that pro-enzymes are resistant to inactivation by numerous protein digesting enzymes, like serpins, which are circulating in the blood. Together with our scientific consultants, we believe that the development of an I.V injection pro-enzyme formulation will lead to improved efficacy in the treatment of cancer compared with current oral enzyme preparations, and will substantially reduce the dose in comparison to that used previously for oral enzyme therapy for the treatment of cancer.

Our Research Programs

POP1

In order to maximize our proprietary knowledge on the use of pro-enzymes in the treatment of cancer, we are currently undertaking research to identify the mechanism at the molecular level by which PRP is acting to cause cancer cell death. A research program has been established with our collaborators at the University of Granada to investigate the changes in genetic and protein expression that occur in cancer cells as a consequence of being exposed to PRP. The objective of this work is to understand PRP on a molecular level changes in gene expression of the cancer cell post treatment. This will enable us to identify new, patentable drugs which we can develop such as synthetic recombinant proteins designed to improve the quality, safety and performance of pro-enzymes used in our current formulations.

Target Indications

The management of cancer differs widely, with a multitude of factors impacting on the choice of treatment strategy. Some of those factors include:

| · | the type of tumor, usually defined by the tissue in the body from which it originated; |

| · | the extent to which it has spread beyond its original location; |

| · | the availability of treatments, driven by multiple factors including cost, drugs approved, local availability of suitable facilities etc.; |

| · | regional and geographic differences; |

| · | whether the primary tumor is amenable to surgery, either as a potentially curative procedure, or as a palliative one; and |

| 17 |

| · | the balance between potential risks and potential benefits from the various treatments, and probably most importantly, the patient’s wishes. |

For many patients with solid cancers, such as breast, colorectal, lung and pancreatic cancer, surgery is frequently the first treatment option, frequently followed by first line chemotherapy +/- radiotherapy. Whilst hopefully such procedures are curative, in many instances the tumor returns, and second line treatment strategies are chosen in an effort to achieve a degree of control of the tumor. In most instances, the benefit is temporary, and eventually the point is reached where the patient’s tumor either fails to adequately respond to treatment, or the treatment has unacceptable toxicity which severely limits its usefulness.

Should the proposed Phase I, II and III clinical trials confirm the efficacy of our product candidates, along with the excellent safety and tolerability profile suggested by pre-clinical studies conducted, to date, our product will have utility in a number of clinical situations including:

| · | in the early stage management of solid tumors, most likely as part of a multi-pronged treatment strategy in combination with existing therapeutic interventions; |

| · | as a product that can be administered long term for patients following standard treatment approaches, such as surgery, or chemotherapy, in order to prevent or delay recurrence. |

| · | as a preventative measure for patients at risk of developing cancer based on genetic screening. |

In the near term, we plan to target patients with solid tumors, most likely colorectal and pancreatic tumors, for whom other treatment options have been exhausted. This is a common approach by which most new drugs for cancer are initially tested. Once efficacy and safety has been demonstrated in this patient population, exploration of the potential utility of the drug in earlier stage disease can be undertaken, together with investigation of the drug’s utility in other types of cancer.

Development Strategy

Our goal is to undertake early stage non-clinical and clinical development of our drug products through to a significant value inflexion point, where the commercial attractiveness of a drug in development, together with a greater likelihood of achieving market authorization, may attract potential interest from licensees seeking to acquire new products. Such value inflexion points in the context of cancer drugs are typically at the point where formal, controlled clinical trials have demonstrated either ‘efficacy’ or ‘proof of concept’ – typically meaning that there is controlled clinical trial evidence that the drug is effective in the proposed target patient population, has an acceptable safety profile, and is suitable for further development. From a ‘big picture’ perspective, it is our intention to progress the development of its technology through to completion of Phase I clinical trials and then to seek a licensee for further development beyond that point.

As part of that commercial strategy, we will:

| · | continue research and development to build our existing intellectual property portfolio, and to seek new, patentable discoveries; |

| · | seek to ensure all product development is undertaken in a manner that makes its products approvable in the major pharmaceutical markets, including the U.S., Europe, the UK and Japan; |

| · | aggressively pursue the protection of our technology through all means possible, including patents in all major jurisdictions, and potentially trade secrets; |

| · | make strategic acquisitions to acquire new companies that have products or services that complement our future goals. |

| 18 |

Development Plan and Milestones

PRP

We plan to progress PRP down a conventional non-clinical and early stage clinical development pathway either in Central, or Eastern Europe for:

| · | the manufacture of PRP for non-clinical development; |

| · | non-clinical safety toxicology studies; |

| · | regulatory approval to conduct a Phase I study in the relevant country, and submit it to the applicable regulatory authority for approval; and |

| · | a twelve month Phase I dose escalating study in cancer patients with advanced solid tumors who have failed one or more previous cancer therapies. |

We anticipate receiving the Phase IIa proof of concept milestone in approximately three years, subject to regulatory approval in Europe and the US, and the results from our research and development and licensing activities.

Our overheads are likely to increase from its current level as our lead product candidate, PRP progresses down the development pathway. This increase will be driven by the need to increase our internal resources in order to effectively manage our research and development activities.

We are initially seeking to raise sufficient capital to complete Phase I clinical trials over the next twenty-four months, although additional capital may be sought after twelve months to support expansion of research and development activities and our overheads (assuming planned expansion of internal resources are approved internally and completed accordingly).

Anticipated timelines

| 2014 | 2015 | 2016 | |||||||||||||||

| Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | ||||||||||

| Complete animal efficacy models on PRP | X | ||||||||||||||||

| Manufacturing, production of drug substance and product for preclinical and clinical trials | X | X | X | ||||||||||||||

| Non-clinical development | X | X | X | ||||||||||||||

| Obtain regulatory approval | X | ||||||||||||||||

| Phase I | X | X | X | X | |||||||||||||

For the period from October to December 2014, we intend to complete animal efficacy models on PRP. We anticipate the cost of the studies to be $150,000.

For the period from January to September 2015, we intend to complete the manufacturing, production of drug substance and product for preclinical and clinical trials, as well as undertaking formal toxicology studies. We anticipate the cost to be $600,000 and $650,000, respectively.

For the period from September 2015 to September 2016, we intend to complete a Phase I study in advanced cancer patients with solid tumors and the anticipated costs will be $900,000 approximately.

| 19 |

Non Clinical Development

Cell line studies have been performed optimizing the ratio of the three components in our product, PRP. These studies demonstrate synergistic activity over the individual components. Additional preclinical efficacy and toxicology studies will be completed in the near future.

Bio-analytical assays for PRP will be developed prior to commencing the dose-range finding studies. In addition, the potential for E-cadherin to be used as a biomarker for PRP activity will be explored.

We are planning to develop PRP as an intravenous injection. Consequently, dose selection for GLP safety toxicology studies will be determined. Twenty – eight day GLP safety studies may also be necessary for PRP.

Clinical Development

It is proposed to perform the first-in-human study in advanced cancer patients with solid tumours. Typically these studies are dose-escalation studies aiming to identify the maximum tolerated dose (MTD). The study design will consist of single- or multiple-center, open-labelled, dose-escalating study in cancer patients with advanced solid tumours who have failed one or more previous therapies. Approximately 20 to 30 patients will be assessed, with the option to expand the MTD cohort to 10 patients. Dose limiting toxicities will be determined at the end of a one month cycle. Pharmacokinetic and exploratory pharmacodynamics data will be collected. Patients will remain on treatment until disease progression or the study finishes, at which time any remaining patients will be transferred to a long-term safety protocol.

If there is any patient with stable

disease or better, as defined by RECIST (Response Evaluation Criteria in Solid Tumors) and the safety profile is suitable then

PRP will progress to a second study.

POP1

As outlined previously, a research program has been established with our collaborators at the University of Granada to investigate the changes in genetic and protein expression that occur in cancer cells as a consequence of being exposed to our pro-enzyme formulation. The objective of this work is to understand at the molecular level the targets of our pro-enzyme formulation, thereby providing the opportunity for new, patentable drugs which can be developed further. We plan to commence a targeted drug discovery program utilizing the identified molecular target to search for novel anticancer agents.

Financial Objectives

Multiple factors, many of which are outside of Propanc’s control, can impact on the ability of Propanc to achieve its target objectives within the planned time and budgetary constraints. Subject to these caveats, it is Propanc’s objective to achieve the following R&D milestones within the proposed budget:

| · | PRP completed Phase I clinical trial. |

| · | Development candidate identified from the POP1 program. |

Corporate Strategy

We operate as a ‘virtual’ company contracting services, skills and expertise as required to achieve our scientific and corporate objectives. As the business grows and gains more personnel, outsourcing will continue to be the preferred model, where fixed and variable costs are carefully managed on a project by project basis. This means our research and development activities will be carried out by third parties. So far, we have engaged our research partners from the Universities of Bath and Granada. Additional third parties with specific expertise in research, compound screening and manufacturing (including raw material suppliers) will be contracted as required. Initial discussions have been held with several third parties and will be contracted as we progress into the next stages of the development process.

| 20 |

Our initial focus will be to organize, coordinate and finance the various parts of the drug development pipeline. New personnel will be carefully introduced into the company over a period of time as the company’s research and development activities expand. They will have specific expertise in product development, manufacture & formulation, regulatory affairs, toxicology, clinical operations and business development (including intellectual property management, licensing and other corporate activities).

In the first instance, additional clinical management and development expertise is likely to be required for our lead product therefore we anticipate an increase in employees in order to effectively manage our contractors as the project progress down the development pathway.

This outsourcing strategy is common in the biotechnology sector, and is an efficient way to obtain access to the necessary skills required to progress a project, in particular as the required skills change as the project progresses from discovery, through manufacturing and non-clinical development, and into clinical trials. We anticipate continuing to utilize this model, thereby retaining the flexibility to contract in the appropriate resource as and when required.

We intend to seek and identify potential licensing partners for our product candidates as they progress through the various development stages, reaching certain milestones and value inflection points. If a suitable licensee is identified, a potential licensing deal could consist of payments for certain milestones, plus royalties from future sales if the product is able to receive approval the relevant regulatory authorities where future product sales are targeted. We intend to seek and identify potential licensees based on the initial efficacy data from Phase I clinical trials within the next 18 to 24 months.

As part of our overall expansion strategy, we are investigating potential intellectual property acquisition opportunities to expand our product portfolio. Whilst the company’s initial focus is on the development of PRP as the lead product candidate, potential product candidates may also be considered for future preclinical and clinical development. These potential opportunities have arisen from other research and development organizations, which either own existing intellectual property, or currently developing new intellectual property, which may be of interest to us. These potential opportunities are potentially new cancer treatments which are potentially less toxic than existing treatment approaches and are able to fill an existing gap in the treatment process, such as a systemic de-bulking method which could reduce the size and threat of metastases to a more manageable level for late stage cancer patients. We believe these potential treatment approaches will be complementary to existing treatment regimens and our existing product candidate, PRP. No formal approaches have been made at this stage and it is unknown whether we will engage in this discussion in the near future. However, we remain hopeful that as PRP progresses further down the development pathway, future opportunities may arise to utilize the expertise of our management and scientific personnel for future prospective research and development projects.

Current Operations

We are at a pre-revenue stage. We do not know when, if ever, we will be able to commercialize our products. Presently, we are focusing our efforts on organizing, coordinating and financing the various aspects of the drug research and development program outlined earlier in this document. In order to commercialize our products, we must complete preclinical development, and Phase I, II and III clinical trials in Europe, the U.S., Australia, or elsewhere, and satisfy the applicable regulatory authority that PRP is safe and effective. We estimate that this will take approximately seven years. As described previously, when we have advanced our development projects sufficiently down the development pathway to achieve a major increase in value, such as obtaining interim efficacy data from Phase I clinical trials, we will seek a suitable licensing partner to complete the remaining development activities, obtain regulatory approval, and market the product.

| 21 |

Current Therapies/Drugs Available

We are developing a therapeutic solution for the treatment of patients with advanced stages of cancer targeting solid tumors, which is cancer that originates in organs or tissues other than bone marrow or the lymph system. Common cancer types classified as solid tumors include lung, colorectal, ovarian cancer, pancreatic cancer and liver cancers. In each of these indications, there is a large market opportunity to capitalize on the limitations of current therapies.

Current therapeutic options for the treatment of cancer offer, at most, a few months of extra life or tumor stabilization. Some experts believe that drugs that kill most tumor cells do not affect cancer stem cells which can regenerate the tumor (e.g. chemotherapy). Studies are revealing the genetic changes in cells that cause cancer and spur its growth this research is providing scientific researchers with dozens of potential “targets” for drugs. Tumor cells, however, can develop resistance to drugs.

Limitations of Current Therapies

PRP was developed because of the limitation of current cancer therapies. While surgery is often safe and effective for early stage cancer, many standard therapies for late stage cancer urgently need improvement; with current treatments generally providing modest benefits, and frequently causing significant adverse effects. Our focus is to provide oncologists and their patients with therapies for metastatic cancer which are more effective than current therapies, and which have a substantially reduced side effect profile.

While progress has been made within the oncology sector in developing new treatments, the overall cancer death rate has only improved 7% over the last 30 years. Most of these new treatments have some limitations, such as:

| · | significant toxic effects; |

| · | expense; and |

| · | limited survival benefits. |

We believe that our treatment will provide a competitive advantage over the following treatments:

| · | Chemotherapeutics: Side effects from chemotherapy can include pain, diarrhea, constipation, mouth sores, hair loss, nausea and vomiting, as well as blood-related side effects, which may include a low number of infection fighting white blood cell count (neutropenia), low red blood cell count (anemia), and low platelet count (thrombocytopenia). Our goal is to demonstrate that our treatment will be more effective than chemotherapeutic and hormonal therapies with fewer side effects. |

| · | Targeted therapies: Most common type is multi-targeted kinase inhibitors (molecules which inhibit a specific class of enzymes called kinases). Common side effects include fatigue, rash, hand–foot reaction, diarrhea, hypertension and dyspnoea (shortness of breath). Furthermore, tyrosine kinases inhibited by these drugs appear to develop resistance to inhibitors. Whilst the clinical findings with PRP are early and subject to confirmation in future clinical trials, no evidence has yet been observed of the development of resistance by the cancer to PRP. |

| · | Monoclonal antibodies: Development of monoclonal antibodies is often difficult due to safety concerns. Side effects which are most common include skin and gastro-intestinal toxicities. For example, several serious side effects from Avastin, an anti-angiogenic cancer drug, include gastrointestinal perforation and dehiscence (e.g. rupture of the bowel), severe hypertension (often requiring emergency treatment) and nephrotic syndrome (protein leakage into the urine). Antibody therapy can be applied to various cancer types in some cases, but can also be limited to certain genetic sub populations in many instances. |

| · | Immunotherapy: There is a long history of attempts to develop therapeutic cancer vaccines to stimulate the body’s own immune system to attack cancer cells. These products, whilst they generally do not have the poor safety profile of standard therapeutic approaches, have rarely been particularly effective. Whilst there are a number of therapeutic cancer vaccines currently in development, most are in the early stages of clinical development. To date, only one therapeutic cancer vaccine has been approved by the US Food and Drug Administration. |

| 22 |

Recent Development

Tarpon Bay Settlement Agreement

In July 2014, we entered into a Settlement and Stipulation Agreement (the “Settlement Agreement”) with Tarpon Bay Partners, LLC (“Tarpon”) to have Tarpon acquire certain portions of our liabilities to creditors (“Creditors”) in exchange for our obligation to issue shares of common stock to Tarpon, which shares of common stock would then be sold by Tarpon and 65% of the net proceeds, as defined, distributed to the Creditors. The shares are to be freely traded shares issued pursuant to section 3(a)(10) of the Securities Act of 1933.

Under the terms of the Settlement Agreement, the variable quantity of common stock would be issued in tranches such that the Tarpon would not own more than 9.99% of the outstanding shares of common stock at any time.

In connection to the Settlement Agreement, in May 2014, we also paid an expense fee of $25,000 in the form of a convertible promissory note.

Tarpon entered into agreements through July 2014 with the Creditors to acquire $627,998 in liabilities of the Company and filed a complaint with the Second Judicial Circuit Court in Leon County, Florida seeking a judgment against the Company for such amount. A court order based on this complaint was issued on September 9, 2014, (the "Court Order Date") resulting in the transfer of $627,998 in liabilities of the Company to the Tarpon. In addition, upon entry of the order, we became obligated to issue to Tarpon a purchaser fee of $50,000 worth of common stock priced at 75% of the average closing bid prices for the 10 days immediately preceding the date of the order. As a result of the purchased liabilities and purchaser fee, we became obligated to issue to the purchaser approximately $1,034,000 worth of common stock. These liabilities now meet the criteria of stock settled debt under ASC 480 resulting in the recording of a liability premium of approximately $356,000 with a charge to interest expense on the court order date.

We issued an initial tranche of 7,426,000 shares of common stock to Tarpon in September 2014.

Issuance of Convertible Promissory Notes

On May 29 and May 30, 2014, we entered into securities purchase agreements with Union Capital, LLC, LG Capital Funding, LLC and Adar Bays, LLC pursuant to which we executed a total of six (6) convertible promissory notes with these purchasers resulting in aggregate loan amount of $200,000. We agreed to pay 8% interest per annum on the principal amount and the maturity dates are May 29 and May 30, 2015. The notes are convertible at the option of the holder at any time after 180 days at a rate of 55% of the lowest trading bid price of the our common stock for the ten (10) prior trading days including the date upon which the conversion notice was received. Proceeds from the financing have been used primarily to support working capital expenses such as accounting, legal, intellectual property and administrative expenses.

| 23 |

Southridge Partners Financing

On July 18, 2014, we entered into an equity purchase agreement (the “EPA”) with Southridge Partners II, L.P. (“Southridge”) pursuant to which, the investor shall, from time to time over the 24-month term of the agreement, commit to purchase up to $5,000,000 of the company’s common stock in connection to put notices by the company. The purchase price of the common stock under the EPA is equal to ninety percent to the lowest closing bid price, quoted by the exchange or principal market company’s common stock is traded on, on any trading day during the ten (10) trading days immediately after the company delivers to Southridge a put notice in writing requiring Southridge to purchase shares of the Company subject to certain terms of the EPA.

In connection with the execution of the EPA, on the same date, we also entered into a registration rights agreement (the “Registration Rights Agreement”) with Southridge. Pursuant to the Registration Rights Agreement, we agreed to have an initial registration statement declared effective within a certain time frame. The mechanics triggering the issuance of those securities were fully negotiated and set forth in the EPA disclosed previously with the SEC.

Also in connection with the execution of the EPA, on the same date, we executed a promissory note to Southridge resulting in a loan amount of $50,000 bearing an interest rate of 0% per annum, with the maturity date ofJanuary 31, 2015.

Market Opportunity

Total global oncology drug sales reached $91 billion in 2013 and are growing at 5% annually. In particular, targeted therapies have significantly increased their share from 11% a decade ago to 46% last year. Biological products, which are products often made from natural resources, such as human, animal and microorganisms, represent nearly half of the oncology market. More recently, new drug launches have concentrated on small molecules, including kinase inhibitors. However, these new drugs cost more because they are meant for smaller patient populations.

Our cancer treatment is intended to be positioned among the five types of cancer drug classes currently contributing to the significant growth in the oncology market. The five main drug classes are chemotherapeutics, hormonals, immunotherapy and vaccines, targeted therapies and monoclonal antibodies.

Demand for new cancer products can largely be attributed to a combination of a rapidly aging population in western countries and changing environmental factors, which together are resulting in rising cancer incidence rates. According to the World Health Organization, all cancers (excluding non-melanoma skin cancer) are expected to increase from 8.2 million annual deaths in 2012 to over 10 million annual deaths by 2020, exceeding 13 million annual deaths by 2030. As such, global demand for new cancer treatments which are effective, safe and easy to administer is rapidly increasing. Our treatment will potentially target many aggressive tumor types for which little or few treatment options exist.

We plan to target patients with solid tumors, most likely colorectal and pancreatic tumors, for whom other treatment options have been exhausted. Globally these cancers resulted in over 694,000 deaths per year in 2012. With such a high mortality rate, a substantial unmet medical need exists for new treatments.

For example, current standard treatment for colorectal cancer consists of cytotoxics, which are associated with high levels of toxicity. Despite the relatively recent approval of Erbitux™ and Avastin™, both of which are monoclonal antibodies, for the treatment of colorectal cancer, significant treatment-related adverse effects continue to be problematic for patients with colorectal cancer. The need exists for tolerable agents that will improve quality of life for patients as well as offering a potential cure (Datamonitor, 2004).

For pancreatic cancer, there is a lack of effective therapies on the market for pancreatic cancer and any newly approved agents with some efficacy are likely to see significant uptake once commercialized (Datamonitor, 2004). Targeted therapies may fulfill this need, although further intensive research and development is necessary.

| 24 |

Once the efficacy and safety of PRP has been demonstrated in late stage patient populations, we plan to undertake exploration of the utility of the drug in earlier stage disease, together with investigation of the drug’s utility in other types of cancer.

Anticipated Market Potential

It is difficult to estimate the size of the market opportunity for this specific type of product as a clinically proven, pro-enzyme formulated suppository marketed to oncologists across global territories for specific cancer indications, to the best of management’s knowledge, has not been previously available.

However, the markets for potential market for colorectal and pancreatic cancer may be characterized as follows:

| · | Colorectal cancer: In 2011, according to available information online, the global colorectal cancer therapeutics market was worth $8.3 billion. The market is expected to decrease marginally to $7.8 billion by 2021 because of generic competition for a key cytotoxic agent, oxaliplatin, as well as the entry of biosimilar competitors for key targeted biological agents. Therefore, demand for new and innovative treatment approaches will be significant to support future growth and continue to improve treatment standards. |