As filed with the Securities and Exchange Commission on August 19, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Propanc Health Group Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 33-0662986 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Propanc Health Group Corporation

Level 2, 555 Riversdale Road

Camberwell, VIC, 3124 Australia

+61 (0)3 9882 0780

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James Nathanielsz

Chief Executive Officer

Propanc Health Group Corporation

Level 2, 555 Riversdale Road

Camberwell, VIC, 3124 Australia

+61 (0)3 9882 0780

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

James M. Jenkins, Esq.

Alexander R. McClean, Esq.

Harter Secrest & Emery LLP

1600 Bausch & Lomb Place

Rochester, New York 14604

(585) 232-6500

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

| (Do not check if a smaller reporting company) | |||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered (1)(2) | Proposed Maximum Offering Price per Share (3) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock, $0.001 par value per share, underlying Warrants | 240,000,000 | $ | 0.0153 | $ | 3,672,000 | $ | 370 | |||||||||

| (1) | This registration statement covers the resale by a certain selling securityholder named herein of up to 240,000,000 shares of our common stock, par value $0.001 per share, issuable upon exercise of outstanding warrants that were issued to the selling securityholder in connection with a private placement. |

| (2) | In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act. |

| (3) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) and Rule 457(o) under the Securities Act of 1933, as amended, based on the last reported sale price of the Registrant’s common stock as reported on the OTCQB Marketplace on August 15, 2016. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Dated August 19, 2016

PRELIMINARY PROSPECTUS (Subject to completion)

PROPANC HEALTH GROUP CORPORATION

240,000,000 Shares of Common Stock

This prospectus relates to the resale by the selling securityholder of Propanc Health Group Corporation, named herein, of 240,000,000 shares of common stock, par value $0.001 per share (the “Common Stock”), currently underlying certain warrants (the “2016 Warrants”), held by the selling securityholder which were initially issued by us on August 3, 2016. The 2016 Warrants entitle the holder thereof to purchase (i) up to 200,000,000 shares of Common Stock at exercise prices ranging from $0.012 to $0.020 per share (the “Five Month Warrants”), and (ii) up to 40,000,000 shares of Common Stock at an exercise price of $0.10 per share (the “Two Year Warrants”).

The registration of the shares of Common Stock hereunder does not mean that the selling securityholder will actually offer or sell the full number of shares being registered pursuant to this prospectus. The selling securityholder may sell the shares of Common Stock to be registered hereby from time to time. The selling securityholder has not engaged any underwriter in connection with the sale of the Common Stock. The selling securityholder may offer and sell the shares in a variety of transactions described under the heading “Plan of Distribution” beginning on page 24, including transactions on any stock exchange, market or facility on which the Common Stock may be quoted or traded, in privately negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to such market prices or at negotiated prices.

We are not selling any securities covered by this prospectus and will not receive any of the proceeds from the sale by the selling securityholder. However, we will receive the exercise price of the 2016 Warrants if the 2016 Warrants are exercised for cash by the securityholder. We are registering the Common Stock on behalf of the selling securityholder. We are bearing all of the expenses in connection with the registration of the shares of Common Stock, but all selling and other expenses incurred by the selling securityholder, including commissions and discounts, if any, attributable to the sale or disposition by such selling securityholder will be borne by it.

Our Common Stock is listed on OTCQB under the symbol “PPCH.” OTCQB is an OTC market tier for companies that report to the Securities and Exchange Commission. On August 11, 2016, the closing price of our Common Stock as reported on OTCQB was $0.0153 per share.

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and as such, we have elected to comply with reduced public company reporting requirements.

Investing in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated , 2016

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any prospectus supplement prepared by or on behalf of us or to which we have referred you. We have not authorized anyone to provide you with information that is different. If anyone provides you with different or inconsistent information, you should not rely upon it. This prospectus is not an offer to sell, nor is the selling securityholder seeking an offer to buy, securities in any state where such offer or solicitation is not permitted. The information in this prospectus is complete and accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our Common Stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: neither we nor the selling securityholder have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of shares of our Common Stock and the distribution of this prospectus outside the United States.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Propanc,” “the company,” “we,” “us,” “our” and similar references refer to Propanc Health Group Corporation.

i

The following summary highlights information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Common Stock. Before you decide to invest in our Common Stock, you should read and carefully consider the following summary together with the entire prospectus, including our financial statements and the related notes thereto appearing elsewhere in this prospectus and the matters discussed in the sections in this prospectus entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See the section in this prospectus entitled “Special Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections of this prospectus.

Our Company

Overview

We are a development stage healthcare company that is currently focused on developing new cancer treatments for patients suffering from pancreatic, ovarian and colorectal cancers. Together with our scientific and oncology consultants, we have developed a rational, composite formulation of anti-cancer compounds, which together exert a number of effects designed to control or prevent tumors from recurring and spreading through the body. Our leading products are variations upon our novel formulation and involve or employ pro-enzymes, which are inactive precursors of enzymes. As a result of positive early indications of the anti-cancer effects of our technology, we intend to submit our pro-enzyme treatment to the rigorous, formal non-clinical and clinical development and trial processes required to obtain the regulatory approval necessary to commercialize it and any product(s) derived and/or to be derived therefrom.

In the near term, we intend to target patients with limited remaining therapeutic options for the treatment of solid tumors such as colorectal, ovarian or pancreatic tumors. In the future, we intend to develop our lead product to treat early stage cancer and pre-cancerous diseases and as a preventative measure for patients at risk of developing cancer based on genetic screening.

Key Highlights:

| · | Potential cancer treatment: We are developing a once-daily pro-enzyme treatment as a therapeutic option in cancer treatment and prevention. |

| · | Multiple mechanisms of action on cancerous or carcinogenic cells: Our treatment exerts multiple effects on cancerous cells, which inhibits tumor growth and potentially stops the tumor from spreading through the body in contrast to cancer treatments currently available that lack sufficient efficacy to achieve a durable clinical response by preventing tumor recurrence or inhibiting new growths which spread through the body. As our research progresses, we intend to explain further the multiple mechanisms of action to identify opportunities to expand our intellectual property portfolio. Furthermore, we hope to uncover the molecular targets of the pro-enzymes to identify potential opportunities for developing new compounds. |

| · | Encouraging data from patient treatment: Scientific research undertaken over the last 15 years and clinical experience from treating patients in the United Kingdom (the “UK”) and Australia has provided evidence that our lead product, PRP, may be an effective treatment against cancer and warrants further development. |

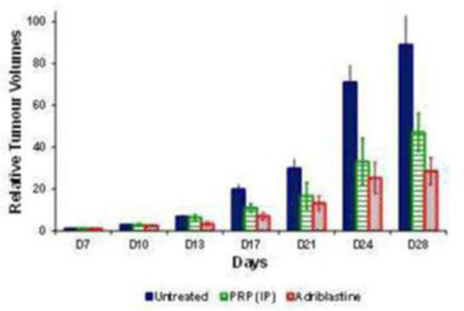

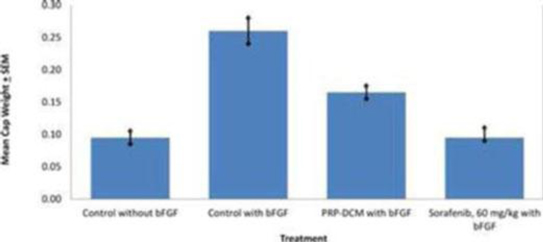

| · | Animal Efficacy Studies: In November 2015, we completed animal efficacy studies in mice through our contract research partner, vivoPharm, demonstrating proof of concept in vivo. During the course of these studies, we discovered a new target therapeutic dose range using proenzymes for treating cancer. That month, we filed a patent application in support of this discovery as further described below. |

| · | Toxicology Study: In July 2016, we announced the commencement of the in-life phase of a formal 28 day toxicology study (including a toxicokinetic arm designed to determine the relationship between the level of exposure of PRP in the blood and its toxicity) according to Good Laboratory Practice (“GLP”) standard, as well as method validation of an infrared dye-labelling method for analyzing the metabolism and distribution of PRP in blood plasma. |

| 1 |

| · | Unique intellectual property: We are focusing on building a significant portfolio of intellectual property around the use of pro-enzymes in the treatment of cancer, identifying new formulations, alternative routes of administration and potential new therapeutic targets. The PRP drug product is an enhanced pro-enzyme formulation comprising amylase and pro-enzymes of trypsinogen and chymotrypsinogen in a specific ratio which synergistically enhances the anti-cancer effects of the pro-enzymes compared to when used as singular entities. Patent protection is currently being sought for this PRP drug product, which forms part of the subject matter of International (PCT) Patent Application No. PCT/AU2010/001403 filed on October 22, 2010 in the name of Propanc Pty Ltd. This international PCT application also includes the priority filings of Australian provisional patent application No. 2009905147 and No. 2010902655, filed on October 22, 2009 and June 17, 2010 respectively (as discussed under the section “Intellectual Property”). The PRP-DCM drug product also forms part of the subject matter of International (PCT) Patent Application No. PCT/AU2010/001403. The Authorized Officer indicated in the Written Opinion issued for this international PCT application, that the patent claims covering the PRP and PRP-DCM products were novel over the prior art cited in the International Search Report. Various national phase applications are being filed in countries around the world based on the above priority applications. In addition, in November 2015, we filed a patent application in Australia in connection with the November 2015 animal efficacy studies. Subsequent applications were filed in Spain and two more in the United States relating to additional discoveries from further cell line studies evaluating the mechanism of action and new compositions of proenzymes, respectively. |

| · | Market opportunity: Growing demand for new cancer treatments continues in part as a result of a rapidly aging population and changing environmental factors in western countries. According to the World Health Organization, all cancers (excluding non-melanoma skin cancer) are expected to increase from 8.2 million annual deaths in 2012 to over 10 million annual deaths by 2020, exceeding 13 million annual deaths by 2030. |

Delafield Financing

On October 28, 2015, we entered into a securities purchase agreement (the “Purchase Agreement”), with Delafield Investments Limited (“Delafield”), the selling securityholder, that provided for the investment of $4,000,000 (the “Investment Amount”) in exchange for a Convertible Debenture (the “Debenture”) in the principal amount of $4,400,000 and warrant (the “2015 Warrant”) to purchase an aggregate of 26,190,476 shares of Common Stock for an exercise price of $0.60 per share for a period of four years from such date. We and Delafield have since modified the terms of the transactions contemplated by the Purchase Agreement pursuant to an addendum dated March 11, 2016 (the “Addendum”), a letter agreement dated July 1, 2016 (the “July Letter Agreement”), and a letter agreement dated August 3, 2016 (the “August Letter Agreement”). The descriptions of the Debenture, the 2015 Warrant and the 2016 Warrants below reflect the terms of such agreements under the Purchase Agreement as modified by the Addendum, the July Letter Agreement and the August Letter Agreement.

In connection with the Purchase Agreement, we filed a registration statement on Form S-1 on November 23, 2015, deemed effective on December 10, 2015, pursuant to which we registered for resale an aggregate of 98,404,985 shares of Common Stock consisting of: (i) 72,214,509 shares underlying the Debenture; and (ii) 26,190,476 shares of Common Stock issuable upon exercise of the 2015 Warrant (the “November Registration Statement”).

Under the terms of the Debenture, we received a reduction in the principal amount of the financing of (i) $25,000 upon the Company’s filing of the November Registration Statement within the time period specified and (ii) $25,000 upon the effectiveness of the November Registration Statement within the time period specified. The current aggregate principal amount was adjusted to $4,350,000 upon the date of the November Registration Statement and $1,559,194 as of August 11, 2016 (the “Principal Amount”). Any references to the “principal amount” or the defined term “Principal Amount” used in this registration statement shall refer to the reduced Principal Amount as described herein.

Pursuant to the Addendum, on March 24, 2016, we filed a registration statement on Form S-1, deemed effective on April 18, 2016, to register for resale up to 171,000,000 additional shares of Common Stock underlying the Debenture.

Debenture

The Debenture has a 10% original issue discount. The Principal Amount of the Debenture accrues interest at the rate of 5% per annum, payable quarterly in cash (or if certain conditions are met, in stock at the Company’s option) on January 1, April 1, July 1 and October 1. Pursuant to the July Letter Agreement, the Company and Delafield agreed to modify the July 1, 2016 “Interest Payment Date” and the October 1, 2016 “Interest Payment Date” as such terms are defined in the Debenture. Pursuant to the July Letter Agreement, the Company may delay the interest payment due on the July 1, 2016 Interest Payment Date by a minimum of 30 calendar days (the “Minimum Extension Date”) and up to 60 calendar days, provided that Delafield may demand payment any time after the Minimum Extension Date. The Company also may delay the interest payment due on the October 1, 2016 Interest Payment Date to the Maturity Date unless Delafield demands earlier payment.

Pursuant to the August Letter Agreement, the maturity date of the Debenture was extended until February 28, 2017 (the “Maturity Date”) and will not accrue interest from October 28, 2016 through the Maturity Date (provided that all accrued but unpaid interest prior to October 28, 2016 (the original maturity date) shall be due and payable pursuant to the terms of the Debenture).

| 2 |

The Debenture is convertible at any time, in whole or in part, at Delafield’s option into shares of Common Stock at a conversion price equal to $0.03 per share; provided that in the event that the volume weighted average price per share on any trading day is less than such conversion price, the conversion price will be adjusted to a price per share that is equal to a 22.5% discount to the lowest trading price of the Common Stock in the 10 trading days prior to the date of conversion. At no time will Delafield be entitled to convert any portion of the Debenture to the extent that after such conversion, Delafield (together with its affiliates) would beneficially own more than 4.99% of the outstanding shares of Common Stock as of such date.

2015 Warrant

Pursuant to the July Letter Agreement, Delafield agreed to exercise the 2015 Warrant with respect to all 26,190,476 shares of Common Stock underlying the 2015 Warrant. In consideration for such exercise, the Company agreed to adjust the exercise price from $0.60 per share to $0.012 per share, for an aggregate exercise price of $314,286.

2016 Warrants

Pursuant to the August Letter Agreement and in consideration for extending the Maturity Date of the Debenture, we issued the 2016 Warrants to Delafield and agreed to file this registration statement with the SEC to register for resale the 240,000,000 shares of Common Stock underlying the 2016 Warrants.

The 2016 Warrants consist of the Five Month Warrant and the Two Year Warrant. The 2016 Warrants are immediately exercisable. On August 18, 2016, Delafield notified us of its exercise of 12,500,000 shares of Common Stock under the first tranche of the Five Month Warrant at a purchase price of $0.012 per share or $150,000 in the aggregate.

Pursuant to the Five Month Warrant, if the Volume Weighted Average Price (as defined in the Five Month Warrant) of the Common Stock for five consecutive days equals or exceeds the exercise price of any tranche of the Five Month Warrants (each, as applicable, a “Callable Tranche”), and provided that the Company is in compliance with the Call Conditions as defined in the August Letter Agreement, the Company has the right to call on Delafield to exercise any warrants under a Callable Tranche up to an aggregate exercise price of $350,000. The Five Month Warrant generally limits the Company to one such call within a twenty trading day period. However, if the Volume Weighted Average Price of the Common Stock for five consecutive trading days is at least 200% of the exercise price of any warrants under a Callable Tranche, the Company may make an additional call for the exercise of additional warrants under such Callable Tranche up to an aggregate exercise price of $600,000 prior to the passage of the twenty trading day period. If Delafield does not exercise the 2016 Warrants under a Callable Tranche when called by the Company under the terms of the August Letter Agreement, we may, at our option, cancel any or all outstanding warrants under the Five Month Warrant.

The exercise price and number of shares of the Common Stock issuable under the 2016 Warrants are subject to adjustments for stock dividends, splits, combinations and pro rata distributions. Any adjustment to the exercise price shall similarly cause the number of shares underlying the 2016 Warrants to be adjusted so that the total value of the 2016 Warrants may increase.

Delafield is subject to a beneficial ownership limitation under the 2016 Warrants such that the Company and Delafield will not effect any exercise of the 2016 Warrants that would cause Delafield (together with its affiliates) to beneficially own in excess of 4.99% of the number of shares of Common Stock outstanding immediately after giving effect to the exercise of the warrant. Delafield, upon notice to the Company, may increase or decrease the beneficial ownership limitation, provided that the beneficial ownership limitation may not exceed 9.99% of the number of shares of Common Stock outstanding immediately after giving effect to the exercise of the warrant.

The Five Month Warrant requires us file a registration statement covering the resale of the shares underlying the warrant within 15 days after August 3, 2016, and to use our commercially reasonable efforts to have the registration statement declared effective by the SEC promptly thereafter and to remain effective for a period of at least twelve months from the date of effectiveness. In the event that a registration statement registering the resale of the shares underlying the Five Month Warrant is not effective on or before October 15, 2016, or is not maintained effective thereafter, the termination date of the Five Month Warrant will be extended until such date that the shares have been registered for at least a period of 90 days, but in no event later than April 30, 2017.

The Two Year Warrant requires us to file a registration statement covering the resale of the shares underlying the warrant within 15 days after August 3, 2016, and to use our commercially reasonable efforts to have the registration statement declared effective by the SEC promptly thereafter and to remain effective for a period of at least three years from the date of effectiveness.

Recent Developments

We negotiated a settlement with Typenex Co-Investment, LLC, a Utah limited liability company (“Typenex”) on May 20, 2016 pursuant to which we paid Typenex $612,000 as payment in full of a certain secured convertible promissory note dated June 4, 2015 held by Typenex. The settlement resolves all pending actions including a private arbitration with Typenex in the State of Utah and lawsuit in the Third Judicial District Court of Salt Lake County, Utah pursuant to which Typenex claimed funds were due under the convertible promissory note. We had filed a counter claim against Typenex in the arbitration that is also resolved by the settlement.

| 3 |

Company History

Propanc Health Group Corporation, formerly Propanc PTY Ltd., is a development stage enterprise incorporated in Melbourne, Victoria, Australia on October 15, 2007. Based in Melbourne, Victoria, Australia since inception, substantially all of the efforts of our Company have been the development of new cancer treatments targeting high-risk patients who need a long-term therapy that prevents the cancer from returning and spreading. The Company anticipates establishing global markets for its technologies.

On November 23, 2010, Propanc Health Group Corporation was incorporated in the state of Delaware. In January 2011, to reorganize the Company, Propanc Health Group Corporation acquired all of the outstanding shares of Propanc PTY Ltd. on a one-for-one basis making it a wholly owned subsidiary.

We were formed for the specific purpose of having shareholders of Propanc PTY Ltd. directly own an interest in a U.S. company. On January 29, 2011, we issued 64,700,525 shares of our Common Stock in exchange for 64,700,525 shares of Propanc PTY Ltd. common stock.

On July 22, 2016, we formed our subsidiary, Propanc (UK) Limited under the laws of England and Wales for the purpose of submitting an orphan drug application to the European Medicines Agency as a small and medium-sized enterprise.

Risks Associated with our Business

Before you invest in our Common Stock, you should carefully consider all the information in this prospectus, including matters set forth under the heading “Risk Factors.” We believe that the following are some of the major risks and uncertainties that may affect us:

| · | We have a short operating history, a relatively new business model, and have not produced significant revenues, which makes it difficult to evaluate our future prospects and increases the risk that we will not be successful; |

| · | Our independent registered accounting firm has expressed concerns about our ability to continue as a going concern. In addition, our ability to continue as a going concern is in substantial doubt absent obtaining adequate new debt or equity financings; |

| · | We have a history of operating losses, which may continue and may harm our ability to obtain financing and continue our operations; |

| · | We will require substantial additional financing to continue to grow our business operations, which would dilute the ownership held by our stockholders. If we are unable to obtain additional financing our business operations may be harmed or discontinued, and if we do obtain additional financing our stockholders may suffer substantial dilution; |

| · | Our current products and services are in early stages of development and may not lead to commercially viable products resulting in harm to our business, results of operations and financial condition; |

| · | If we are unable to adequately compete with our competitors, some of whom may have greater resources with which to compete, it may impact our ability to effectively develop, market and sell our products; |

| · | If we are unable to retain the services of key personnel, we may not be able to continue our operations; |

| · | Our intellectual property rights are valuable, and any inability to protect them, including the potential that pending or future patents may not be granted, could reduce the value of our products, services and brand; and |

| · | Intellectual property litigation could harm our business. |

Our Corporate Information

Our principal executive offices are located at Level 2, 555 Riversdale Road, Camberwell, VIC, 3124 Australia, and our telephone number is +61 (0)3 9882 0780. Our website address is www.propanc.com. Our website and the information contained on, or that can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on any such information in making your decision to purchase our Common Stock.

| 4 |

Implications of Being an Emerging Growth Company

We qualify as an emerging growth company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| · | A requirement to have only two years of audited financial statements and only two years of related management’s discussion and analysis; |

| · | Exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002; |

| · | Reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

| · | No non-binding advisory votes on executive compensation or golden parachute arrangements. |

We have already taken advantage of these reduced reporting burdens in this prospectus, which are also available to us as a smaller reporting company as defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards.

We could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

The Offering

| Common Stock outstanding prior to this offering (1) | 756,576,788 shares. | |

| Common Stock offered by the selling securityholder | 240,000,000 shares. | |

| Common Stock to be outstanding assuming full exercise of the 2016 Warrants (2) | 996,576,788 shares. | |

| Use of proceeds | We will not receive any proceeds from the sale of shares in this offering by the selling securityholder. See “Use of Proceeds” beginning on page 28. | |

| OTCQB Market Symbol | PPCH |

| (1) | The number of shares of Common Stock outstanding prior to this offering is based on 756,576,788 shares outstanding as of August 11, 2016 and excludes the following: |

| · | 617,756,808 shares of Common Stock reserved for issuance pursuant to certain convertible debt instruments; |

| · | 47,666,666 shares of Common Stock issuable upon exercise of outstanding stock options, at a weighted average exercise price of $4.68 per share; and |

| · | 277,569,634 shares of Common Stock issuable upon exercise of outstanding warrants, at a weighted average exercise price of $1.02 per share. |

| (2) | The total number of shares of our Common Stock outstanding after this offering is based on 756,576,788 shares outstanding as of August 11, 2016. |

5

There are numerous risks affecting our business, some of which are beyond our control. An investment in our Common Stock involves a high degree of risk and may not be appropriate for investors who cannot afford to lose their entire investment. If any of the following risks actually occur, our business, financial condition or operating results could be materially harmed. This could cause the trading price of our Common Stock to decline and you may lose all or part of your investment. In addition to the risks outlined below, risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. Potential risks and uncertainties that could affect our operating results and financial condition include, without limitation, the following:

RISKS RELATED TO OUR FINANCIAL CONDITION AND OUR NEED FOR ADDITIONAL CAPITAL

Our independent registered accounting firm has expressed concerns about our ability to continue as a going concern. Our ability to continue as a going concern is in substantial doubt absent obtaining adequate new debt or equity financings.

The report of our independent registered accounting firm expresses concern about our ability to continue as a going concern based on the absence of significant revenues, recurring losses from operations and our need for additional financing to fund all of our operations. Working capital limitations continue to impinge on our day-to-day operations, thus contributing to continued operating losses. For the three and nine months ended March 31, 2016, we had net losses of $2,151,909 and $6,552,870, respectively. For the years ended June 30, 2015 and 2014, we had net losses of $3,412,754 and $829,564, respectively. Further, as of March 31, 2016, we had $1,479,026 in cash, $21,628 in receivable accounts and had an accumulated deficit of $27,518,541. As of June 30, 2015, we had $107,627 in cash, $11,647 in receivable accounts and had an accumulated deficit of $20,965,671.

Based upon our current business plans, we will need considerable cash investments to be successful. Although in July 2016 we raised $314,286 in connection with the 2015 Warrant conversion and in October 2015 we raised a significant debt financing of approximately $4,000,000 which should give us enough available cash to meet our obligations over the next 12 months, our capital requirements and cash needs are significant and continuing. We can provide no assurance that we will be able to generate a sufficient amount of revenue, if any, from our business in order to achieve profitability. It is not possible at this time for us to predict with assurance the potential success of our business. The revenue and income potential of our proposed business and operations are unknown. If we cannot continue as a viable entity, we may be unable to continue our operations and you may lose some or all of your investment in our Common Stock.

We have incurred significant losses since our inception. We expect to incur losses for the foreseeable future and never achieve or maintain profitability.

Since inception, we have incurred significant operating losses. Our net loss was $2,151,909 and $6,552,870, respectively for the three and nine months ended March 31, 2016, and was $3,412,754 for the year ended June 30, 2015. As of March 31, 2016 and June 30, 2015, we had a deficit accumulated during the development phase of $27,518,541 and $20,965,671, respectively. To date, we have not generated any revenues and have financed our operations with funds obtained from private financings and related party transactions with directors and other officers. From October 2007, we have devoted substantially all of our efforts to research and development of our product candidates and from June 20, 2015 to November 12, 2015, we did a number of laboratory studies examining the anti-cancer effects of our lead product candidates, which has resulted in additional patent specifications prepared for filing and implementing plans to progress our lead product candidate into human studies. More recently, from January to February 2016, we completed a dose range finding study in rodents and conducted a scientific advice meeting with the UK regulatory agency to discuss formal GLP animal safety/toxicology studies and Phase I and II clinical trials for our lead product. We expect that it will be many years, if ever, before we have a product candidate ready for commercialization. We expect to incur significant expenses and increasing operating losses for the foreseeable future. We anticipate that our expenses will increase substantially if and as we:

| · | continue to develop and progress our lead product candidate into human trials; |

| · | continue our research and development efforts; |

| · | initiate clinical trials for our product candidates; |

| · | seek regulatory approvals for our product candidates that successfully complete clinical trials; |

| · | establish a sales, marketing and distribution infrastructure; |

| · | maintain, expand and protect our intellectual property portfolio; and |

| · | add operational, financial and management information systems and personnel, including personnel to support our product development and planned future commercialization efforts. |

To become profitable, we must develop and eventually commercialize a product or products with significant market potential. This will require us to successfully complete pre-clinical testing and clinical trials of our product candidates, obtain market approval for our product candidates and manufacturing, marketing and selling those products that we obtain market approval for. We might not succeed in any one or a number of these activities, and even if we do, we may never generate revenues that are significant or large enough to achieve profitability. Our failure to become and remain profitable would decrease our value and could impair our ability to raise capital, maintain our research and development efforts, expand our business or continue our operations. A decline in the value of our company could also cause you to lose all or part of your investment.

6

Our short operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

We are an early stage company. We commenced active operations in the second half of 2010. Our operations to date have been limited to establishing our research programs and partnerships, building our intellectual property portfolio and deepening our scientific understanding of our product candidates. We have not yet demonstrated our ability to successfully complete any clinical trials, including large-scale, pivotal clinical trials, obtain marketing approvals, manufacture a commercial scale product, or arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful product commercialization. It will take a number of years for our product to be made available for the treatment of cancer, if ever. Given our short operating history compared to the timeline required to fully develop a new drug, you are cautioned about making any predictions on our future success or viability based on our activities or results to date. In addition, as a new business, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors. We will need to transition from a company with a research focus to a company capable of supporting commercial activities. We may not be successful in such a transition.

We will continue to need substantial additional funding. If we are unable to raise capital when needed, we would be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

We expect our expenses to increase in connection with our ongoing activities, particularly as we expand our research and development activities and initiate clinical trials of, and seek marketing approval for, our product candidates. In addition, if we obtain marketing approval for any of our product candidates, we expect to incur significant commercialization expenses related to product sales, marketing, manufacturing and distribution. Accordingly, we will need to obtain substantial additional funding in connection with our continuing operations. If we are unable to raise capital when needed or on attractive terms, we would be forced to delay, reduce or eliminate our research and development programs or any future commercialization efforts.

Our future capital requirements will depend on many factors, including:

| · | assuming favorable clinical results, the cost, timing and outcome of our efforts to seek approval in the United States and elsewhere in the world, including to fund the preparation and filing of regulatory submissions with the Food and Drug Administration (“FDA”) and other regulatory agencies worldwide; |

| · | the scope, progress and, results of our other ongoing and potential future clinical trials; |

| · | the extent to which we acquire or in-license other products and technologies; |

| · | the costs, timing and outcome of regulatory review of our product candidates; |

| · | the costs of future commercialization activities, including product sales, marketing, manufacturing and distribution, for any of our product candidates for which we receive marketing approval; |

| · | revenue, if any, received from commercial sales of our product candidates, should any of our product candidates receive marketing approval; |

| · | the costs of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending intellectual property-related claims; and |

| · | our ability to establish collaborations on favorable terms, if at all. |

Identifying potential product candidates and conducting preclinical testing and clinical trials is a time-consuming, expensive and uncertain process that takes years to complete, and we may never generate the necessary data or results required to obtain marketing approval and achieve product sales. In addition, our product candidates, if approved, may not achieve commercial success. Our commercial revenues, if any, will be derived from sales of products that we do not expect to be commercially available for many years, if at all. Accordingly, we will need to continue to rely on additional financing to achieve our business objectives. Adequate additional financing may not be available to us on acceptable terms, or at all.

Raising additional capital may cause dilution to our stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of equity offerings, debt financings, collaborations, strategic alliances and licensing arrangements. To the extent that we raise additional capital through the sale of equity or debt securities, including convertible debt securities, the ownership interest of our existing stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of our existing stockholders. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends.

If we raise additional funds through collaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

7

We maintain our cash in Australian financial institutions that are not insured.

The Company maintains its cash in banks and financial institutions in Australia. Bank deposits in Australian banks are uninsured. The Company has not experienced any losses in such accounts through August 11, 2016.

RISKS RELATED TO THE DISCOVERY, DEVELOPMENT AND COMMERCIALIZATION OF OUR PRODUCT CANDIDATES

Because our product candidates are in the early stages of development and may never lead to commercially viable drugs, you may lose your investment.

We are a research and development company presently focused on the development of new cancer treatments, all of which are at an early stage of development, which may be effective in treating cancer and have use in reducing the risk of cancer recurrence. Our drug development methods may not lead to commercially viable drugs for any of several reasons. For example, we may fail to identify appropriate compounds, our drug candidates may fail to be safe and effective in additional preclinical or clinical trials, or we may have inadequate financial or other resources to pursue discovery and development efforts for new drug candidates. Our product candidates will require significant additional development, clinical trials, regulatory clearances and additional investment by us before they can be commercialized. If, for any of these reasons, we are unsuccessful at commercializing our drug candidates, you may lose your investment.

At present, both of our lead product candidates, PRP and PRP-DCM, are still in preclinical development. A formal GLP toxicology study will be completed to ensure the safety of our product candidate, PRP, prior to entering into clinical trials for testing in humans. Further work is also needed for PRP-DCM to better understand which animal models are most appropriate, and determining the optimal combination for PRP-DCM prior to proceeding into formal preclinical studies and into clinical trials.

Our products may cause undesirable side effects that could limit their use, require their removal from the market or prevent further development.

Side effects that may be caused by our products could interrupt, delay or halt our development programs, including clinical trials, and could result in adverse regulatory action by the FDA or other regulatory authorities. More severe side effects associated with our products may be also observed in the future. Even if we are able to complete the development of a new product and obtain any required regulatory approval, undesirable side effects could prevent us from achieving or maintaining market acceptance of the product or could substantially increase the costs and expenses of commercializing the product. Negative publicity concerning our products, whether accurate or inaccurate, could also reduce market or regulatory acceptance of our products, which could result in decreased product demand, removal from the market or an increased number of product liability claims, whether or not such claims have merit.

Because successful development of our products is uncertain, our results of operations may be materially harmed.

Our development of current and future product candidates is subject to the risks of failure and delay inherent in the development of new pharmaceutical products and products based on new technologies, including but not limited to the following:

| · | delays in product development, clinical testing or manufacturing; |

| · | unplanned expenditures in product development, clinical testing or manufacturing; |

| · | unexpected scientific, non-clinical or clinical findings relating to safety or efficacy; |

| · | failure to receive regulatory approvals; |

| · | emergence of superior or equivalent products; |

| · | inability to manufacture our product candidates on a commercial scale on our own, or in collaboration with third parties; and |

| · | failure to achieve market acceptance. |

Because of these risks, our development efforts may not result in any commercially viable products. If a significant portion of these development efforts are not successfully completed, required regulatory approvals will not be obtained, or if any approved products are not commercialized successfully, our business, financial condition and results of operations may be materially harmed.

Additional preclinical testing and clinical trials of our product candidates may not be successful if we are unable to commercialize our product candidates or experience significant delays in doing so, our business may be harmed.

We have conducted a variety of pre-clinical studies, which have provided evidence supporting the potential therapeutic utility of our lead product candidates, PRP and PRP-DCM. Studies include the in vitro assessment of these product’s key components on cell growth and differentiation, and in vitro combination assays identifying synergistic effects by optimizing the ratios between the key components. In addition, we, together with our scientific founder, Dr. Julian Kenyon, have undertaken a retrospective analysis of cancer patients treated with PRP under UK and Australian compassionate access schemes. This review has generated clinical evidence supportive of the further development of PRP as a potential therapeutic for cancer.

8

However, before regulatory approval can be obtained for the commercial sale of PRP, or the other product candidates currently under development by us, we will be required to complete formal preclinical studies and then comprehensive clinical trials in order to demonstrate the product’s safety, tolerability and efficacy. Regulatory approval to market a new product will only be obtained once we can demonstrate to the satisfaction of the applicable regulatory authority that the product candidate has an acceptable safety profile, is effective in treating the target indication and otherwise meets the appropriate standards required by regulators for approval.

Clinical testing is expensive, difficult to design and implement, can take many years to complete and is uncertain as to outcome. A failure of one or more clinical trials can occur at any stage of testing. The outcome of preclinical testing and early clinical trials may not be predictive of the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that have believed their product candidates performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain marketing approval of their products.

We may experience numerous unforeseen events during, or as a result of, clinical trials that could delay or prevent our ability to receive marketing approval or commercialize our product candidates, including:

| · | regulators or institutional review boards may not authorize us or our investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site; |

| · | we may have delays in reaching or fail to reach an agreement on acceptable clinical trial contracts or clinical trial protocols with prospective trial sites; clinical trials of our product candidates may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical trials or abandon product development programs; |

| · | the number of patients required for clinical trials of our product candidates may be larger than we anticipate, enrollment in these clinical trials may be slower than we anticipate or participants may drop out of these clinical trials at a higher rate than we anticipate; |

| · | our third-party contractors may fail to comply with regulatory requirements or fail to meet their contractual obligations to us in a timely manner, or at all; |

| · | we might have to suspend or terminate clinical trials of our product candidates for various reasons, including a finding that the participants are being exposed to unacceptable health risks; |

| · | regulators or institutional review boards may require that we or our investigators suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements or a finding that the participants are being exposed to unacceptable health risks; |

| · | the cost of clinical trials of our product candidates may be greater than we anticipate; |

| · | the supply or quality of our product candidates or other materials necessary to conduct clinical trials of our product candidates may be insufficient or inadequate; and |

| · | our product candidates may have undesirable side effects or other unexpected characteristics, causing us or our investigators, regulators or institutional review boards to suspend or terminate the trials. |

If we are required to conduct additional clinical trials or other testing of our product candidates beyond those that we currently contemplate, if we are unable to successfully complete clinical trials of our product candidates or other testing, if the results of these trials or tests are not positive or are only modestly positive or if there are safety concerns, we may:

| · | be delayed in obtaining marketing approval for our product candidates; |

| · | not obtain marketing approval at all; |

| · | obtain approval for indications or patient populations that are not as broad as intended or desired; |

| · | obtain approval with labeling that includes significant use or distribution restrictions or safety warnings, including boxed warnings; |

| · | be subject to additional post-marketing testing requirements; or |

| · | have the product removed from the market after obtaining marketing approval. |

Any delay in, or termination of, our clinical trials may result in increased development costs for our products, which would cause the market price of our shares to decline and limit our ability to obtain additional financing and, ultimately, our ability to commercialize our products and generate product revenues. Any change in, or termination of, our clinical trials could materially harm our business, financial condition and results of operations.

9

If we experience delays or difficulties in the enrollment of patients in clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented.

We may not be able to initiate or continue clinical trials for our product candidates if we are unable to locate and enroll a sufficient number of eligible patients to participate in these trials as required by the FDA or similar regulatory authorities outside the United States. In addition, there are a number of ongoing clinical trials for product candidates treating cancer. Patients who would otherwise be eligible for our clinical trials may instead enroll in clinical trials of our competitors' product candidates, particularly if they view such treatments to be more conventional and established.

Patient enrollment is affected by other factors including:

| · | severity of the disease under investigation; |

| · | eligibility criteria for the study in question; |

| · | perceived risks and benefits of the product candidate under study; |

| · | efforts to facilitate timely enrollment in clinical trials; |

| · | patient referral practices of physicians; |

| · | the ability to monitor patients adequately during and after treatment; and |

| · | proximity and availability of clinical trial sites for prospective patients. |

Our inability to enroll a sufficient number of patients for our clinical trials would result in significant delays or may require us to abandon one or more clinical trials altogether. Enrollment delays in our clinical trials may result in increased development costs for our product candidates, which would cause the value of our company to decline and limit our ability to obtain additional financing.

If serious adverse or unexpected side effects are identified during the development of our product candidates, we may need to abandon or limit our development of some of our product candidates.

All of our product candidates are in preclinical development or early stages of clinical development and their risk of failure is high. It is impossible to predict when or if any of our product candidates will prove effective or safe in humans or will receive marketing approval. If our product candidates are associated with undesirable side effects or have characteristics that are unexpected, we may need to abandon their development or limit development to certain uses or subpopulations in which the undesirable side effects or other characteristics are less prevalent, less severe or more acceptable from a risk-benefit perspective. Many compounds that initially showed promise in early stage testing for treating cancer have later been found to cause side effects that prevented further development of the compound.

If we fail to obtain regulatory approval in jurisdictions outside the United States, we will not be able to market our products in those jurisdictions.

We intend to seek regulatory approval for our product candidates in a number of countries outside of the United States and expect that these countries will be important markets for our products, if approved. Marketing our products in these countries will require separate regulatory approvals in each market and compliance with numerous and varying regulatory requirements. The regulations that apply to the conduct of clinical trials and approval procedures vary from country to country and may require additional testing. Moreover, the time required to obtain approval may differ from that required to obtain FDA approval. In addition, in many countries outside the United States, drugs must be approved for reimbursement before it can be approved for sale in that country. Approval by the FDA does not ensure approval by regulatory authorities in other countries or jurisdictions, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or by the FDA. The foreign regulatory approval process may include all of the risks associated with obtaining FDA approval. We may not obtain foreign regulatory approvals on a timely basis, if at all. We may not be able to file for regulatory approvals and may not receive necessary approvals to commercialize our products in any foreign market.

Even if regulatory approval is obtained, our products will be subject to extensive post-approval regulation.

Once a product is approved, numerous post-approval requirements apply, including but not limited to requirements relating to manufacturing, labeling, packaging, advertising and record keeping. Even if regulatory approval of a product is obtained, the approval may be subject to limitations on the uses for which the product may be marketed, or contain requirements for costly post-marketing testing and surveillance to monitor the safety or efficacy of the product. Any such post-approval requirement could reduce our revenues, increase our expenses and render the approved product candidate not commercially viable. In addition, as clinical experience with a drug expands after approval because it is typically used by a greater number and more diverse group of patients after approval than during clinical trials, side effects and other problems may be observed after approval that were not seen or anticipated during pre-approval clinical trials or other studies. Any adverse effects observed after the approval and marketing of a product candidate could result in limitations on the use of such approved product or its withdrawal from the marketplace. Absence of long-term safety data may also limit the approved uses of our products. If we fail to comply with the regulatory requirements of the applicable regulatory authorities, or if previously unknown problems with any approved commercial products, manufacturers or manufacturing processes are discovered, we could be subject to administrative or judicially imposed sanctions or other setbacks, including:

10

| · | restrictions on the products, manufacturers or manufacturing processes; |

| · | warning letters and untitled letters; |

| · | civil penalties and criminal prosecutions and penalties; |

| · | fines; |

| · | injunctions; |

| · | product seizures or detentions; |

| · | import or export bans or restrictions; |

| · | voluntary or mandatory product recalls and related publicity requirements; |

| · | suspension or withdrawal of regulatory approvals; |

| · | total or partial suspension of production; and |

| · | refusal to approve pending applications for marketing approval of new products or of supplements to approved applications. |

If we are slow or unable to adapt to changes in existing regulatory requirements or the promulgation of new regulatory requirements or policies, we or our licensees may lose marketing approval for our products which will impact our ability to conduct business in the future.

Even if any of our product candidates receive marketing approval, they may fail to achieve the degree of market acceptance by physicians, patients, healthcare payors and others in the medical community necessary for commercial success.

If any of our product candidates receive marketing approval, they may nonetheless fail to gain sufficient market acceptance by physicians, patients, healthcare payors and others in the medical community. For example, current cancer treatments like chemotherapy and radiation therapy are well established in the medical community, and doctors may continue to rely on these treatments. If our product candidates do not achieve an adequate level of acceptance, we may not generate significant product revenues and we may not become profitable. The degree of market acceptance of our product candidates, if approved for commercial sale, will depend on a number of factors, including:

| · | efficacy and potential advantages compared to alternative treatments; |

| · | the ability to offer our products for sale at competitive prices; |

| · | convenience and ease of administration compared to alternative treatments; |

| · | the willingness of the target patient population to try new therapies and of physicians to prescribe these therapies; |

| · | the strength of marketing and distribution support; |

| · | sufficient third-party coverage or reimbursement; and |

| · | the prevalence and severity of any side effects. |

We intend to conduct business in multiple countries, where we will be exposed to political, economic and other risks that may adversely affect our business.

Currently our headquarters are in Australia, but we intend to penetrate other markets in the future. At such time, we will therefore be exposed to risks inherent in international operations. These risks include, but are not limited to:

| · | changes in general economic, social and political conditions; |

| · | adverse tax consequences; |

| · | the difficulty of enforcing agreements and collecting receivables through certain legal systems; |

| · | inadequate protection of intellectual property; |

| · | required compliance with a variety of laws and regulations in jurisdictions outside of Australia, including labor and tax laws; and |

| · | customers outside of the United States with longer payment cycles. |

Our business success depends in part on our ability to anticipate and effectively manage these and other regulatory, economic, social and political risks inherent in a multinational business. We cannot assure you that we will be able to effectively manage these risks or that they will not have a material adverse effect on our multinational business or on our business as a whole.

11

If, in the future, we are unable to establish sales and marketing capabilities or enter into agreements with third parties to sell and market our product candidates, we may not be successful in commercializing our product candidates if and when they are approved.

We do not have a sales or marketing infrastructure and have no experience in the sale, marketing or distribution of pharmaceutical products. To achieve commercial success for any approved product, we must either develop a sales and marketing organization or outsource these functions to third parties. In the future, we may choose to build a focused sales and marketing infrastructure to market or co-promote some of our product candidates if and when they are approved.

There are risks involved with both establishing our own sales and marketing capabilities and entering into arrangements with third parties to perform these services. For example, recruiting and training a sales force is expensive and time consuming and could delay any product launch. If the commercial launch of a product candidate for which we recruit a sales force and establish marketing capabilities is delayed or does not occur for any reason, we would have prematurely or unnecessarily incurred these commercialization expenses. This may be costly, and our investment would be lost if we cannot retain or reposition our sales and marketing personnel.

Factors that may inhibit our efforts to commercialize our products on our own include:

| · | our inability to recruit and retain adequate numbers of effective sales and marketing personnel; |

| · | the inability of sales personnel to obtain access to physicians or persuade an adequate numbers of physicians to prescribe any future products; |

| · | the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage relative to companies with more extensive product lines; and |

| · | unforeseen costs and expenses associated with creating an independent sales and marketing organization. |

If we enter into arrangements with third parties to perform sales, marketing and distribution services, our product revenues or the profitability of these product revenues to us are likely to be lower than if we were to market and sell any products that we develop ourselves. In addition, we may not be successful in entering into arrangements with third parties to sell and market our product candidates or may be unable to do so on terms that are favorable to us. We likely will have little control over such third parties, and any of them may fail to devote the necessary resources and attention to sell and market our products effectively. If we do not establish sales and marketing capabilities successfully, either on our own or in collaboration with third parties, we will not be successful in commercializing our product candidates.

We face substantial competition, which may result in others discovering, developing or commercializing products before or more successfully than we do.

The development and commercialization of new drug products is highly competitive. We face competition with respect to our current product candidates, and will face competition with respect to any product candidates that we may seek to develop or commercialize in the future from major pharmaceutical companies, specialty pharmaceutical companies and biotechnology companies worldwide. There are a number of large pharmaceutical and biotechnology companies that currently market and sell products or are pursuing the development of products for the treatment of the disease indications for which we are developing our product candidates. Some of these competitive products and therapies are based on scientific approaches that are the same as or similar to our approach, and others are based on entirely different approaches. Potential competitors also include academic institutions, government agencies and other public and private research organizations that conduct research, seek patent protection and establish collaborative arrangements for research, development, manufacturing and commercialization.

We are developing our product candidates for the treatment of cancer. There are a variety of available therapies marketed for cancer. In many cases, these drugs are administered in combination to enhance efficacy. Some of these drugs are branded and subject to patent protection, and others are available on a generic basis. Many of these approved drugs are well-established therapies and are widely accepted by physicians, patients and third-party payors. Insurers and other third-party payors may also encourage the use of generic products. We expect that if our product candidates are approved, they will be priced at a significant premium over competitive generic products. This may make it difficult for us to achieve our business strategy of using our product candidates in combination with existing therapies or replacing existing therapies with our product candidates.

There are also a number of products in clinical development by third parties to treat and prevent metastatic cancer. These companies include divisions of large pharmaceutical companies, including Astellas Pharma US, Inc., Sanofi-Aventis US LLC, GlaxoSmithKline plc, Boehringer Ingelheim GmbH, Pfizer Inc. and others. There are also biotechnology companies of various sizes that are developing therapies against cancer stem cells (“CSCs”) (i.e. cancer cells which have transformed to become motile and invasive, triggering metastasis, and are chemo-resistant), including Verastem, OncoMed Pharmaceuticals, Inc., Boston Biomedical, Inc. and Stemline Therapeutics, Inc. Our competitors may develop products that are more effective, safer, more convenient or less costly than any that we are developing or that would render our product candidates obsolete or non-competitive. In addition, our competitors may discover biomarkers that more efficiently measure their effectiveness to treat and prevent metastatic cancer, which may give them a competitive advantage in developing potential products. Our competitors may also obtain marketing approval from the FDA or other regulatory authorities for their products more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market.

12

Many of our competitors have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller and other early stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These third parties compete with us in recruiting and retaining qualified scientific and management personnel, establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs. In addition, to the extent that product or product candidates of our competitors demonstrate serious adverse side effects or are determined to be ineffective in clinical trials, the development of our product candidates could be negatively impacted.

Even if we are able to commercialize any product candidates, the products may become subject to unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives, which would harm our business.

The regulations that govern marketing approvals, pricing and reimbursement for new drug products vary widely from country to country. In the United States, recently passed legislation may significantly change the approval requirements in ways that could involve additional costs and cause delays in obtaining approvals. Some countries require approval of the sale price of a drug before it can be marketed. In many countries, the pricing review period begins after marketing or product licensing approval is granted. In some foreign markets, prescription pharmaceutical pricing remains subject to continuing governmental control even after initial approval is granted. As a result, we might obtain marketing approval for a product in a particular country, but then be subject to price regulations that delay our commercial launch of the product, possibly for lengthy time periods, and negatively impact the revenues we are able to generate from the sale of the product in that country. Adverse pricing limitations may hinder our ability to recoup our investment in one or more product candidates, even if our product candidates obtain marketing approval.

Our ability to commercialize any products successfully also will depend in part on the extent to which reimbursement for these products and related treatments will be available from government health administration authorities, private health insurers and other organizations. Government authorities and third-party payors, such as private health insurers and health maintenance organizations, decide which medications they will pay for and establish reimbursement levels. A primary trend in the U.S. healthcare industry and elsewhere is cost containment. Government authorities and third-party payors have attempted to control costs by limiting coverage and the amount of reimbursement for particular medications. Increasingly, third-party payors are requiring that drug companies provide them with predetermined discounts from list prices and are challenging the prices charged for medical products. We cannot be sure that reimbursement will be available for any product that we commercialize and, if reimbursement is available, the level of reimbursement. Reimbursement may impact the demand for, or the price of, any product candidate for which we obtain marketing approval. Obtaining reimbursement for our products may be particularly difficult because of the higher prices often associated with drugs administered under the supervision of a physician. If reimbursement is not available or is available only to limited levels, we may not be able to successfully commercialize any product candidate for which we obtain marketing approval.

There may be significant delays in obtaining reimbursement for newly approved drugs, and coverage may be more limited than the purposes for which the drug is approved by the FDA or similar regulatory authorities outside the United States. Moreover, eligibility for reimbursement does not imply that any drug will be paid for in all cases or at a rate that covers our costs, including research, development, manufacture, sale and distribution. Interim reimbursement levels for new drugs, if applicable, may also not be sufficient to cover our costs and may not be made permanent. Reimbursement rates may vary according to the use of the drug and the clinical setting in which it is used, may be based on reimbursement levels already set for lower cost drugs and may be incorporated into existing payments for other services. Net prices for drugs may be reduced by mandatory discounts or rebates required by government healthcare programs or private payors and by any future relaxation of laws that presently restrict imports of drugs from countries where they may be sold at lower prices than in the United States. Third-party payors often rely upon Medicare coverage policy and payment limitations in setting their own reimbursement policies. Our inability to promptly obtain coverage and profitable payment rates from both government-funded and private payors for any approved products that we develop could have a material adverse effect on our operating results, our ability to raise capital needed to commercialize products and our overall financial condition.

Product liability lawsuits against us could cause us to incur substantial liabilities and to limit commercialization of any products that we may develop.

We face an inherent risk of product liability exposure related to the testing of our product candidates in human clinical trials and will face an even greater risk if we commercially sell any products that we may develop. If we cannot successfully defend ourselves against claims that our product candidates or products caused injuries, we will incur substantial liabilities. Regardless of merit or eventual outcome, liability claims may result in:

13

| · | decreased demand for any product candidates or products that we may develop; |

| · | injury to our reputation and significant negative media attention; |